5 Things We Watch: UK & US CPI, Gaza, JPY, and Banks

Hello Everybody and welcome back for our weekly 5 Things We Watch! We dare say we have a diversified edition this week touching on everything from Japan to Gaza and New York Community Bank!

Without further ado lets dive right into it!

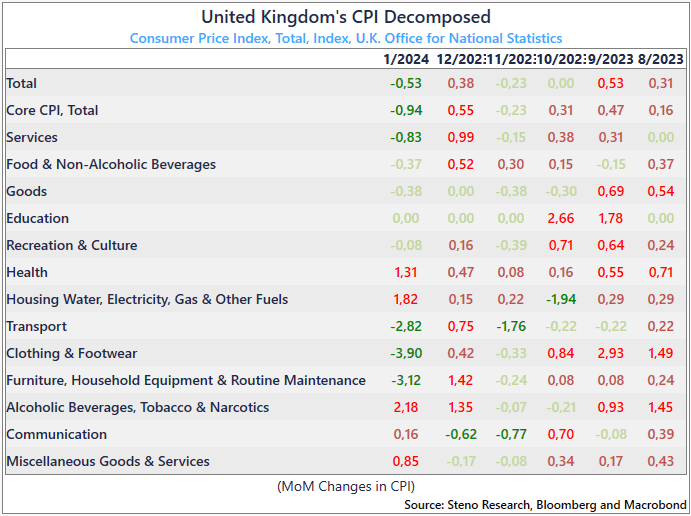

1) UK CPI: Smack dab at our soft forecast

Today’s UK CPI report was very very soft compared to expectations, especially in services, as we predicted. This is more or less smack dab at our dovish forecast – one that we truly had our troubles defending yesterday after the US CPI report.

Some details from the report:

- Services printing at -0.83%, smack dab at our forecast

- Strong discount season in clothing and footwear, furniture and transport

- The only major component pulling in the other direction is the housing/energy component.

A UK Services print at -0.8% is less than 0.2% MoM in seasonally adjusted terms, which is what the BoE needs to cut in May. Consequently, we see a gap opening of 12 bps lower in the front of the GBP curve. Not an overwhelming move given the softness of the print in MoM terms (also accounting for seasonality).

There is a tremendous scope to get service inflation down in YoY terms over the next quarter in the UK. Based on a trend of 0.25% MoM in UK Services CPI, we could be back at 3.15% YOY in April due to enormous base-effects in the coming three months.

It is a bit of a stretch to hope for 0.25% service inflation in April but not in February/March and this is likely going to bring “May back in Play” in the GBP curve.

Chart 1.a: UK CPI Decomposition

The US CPI dealt a harsh blow to risk assets and those betting on disinflation, yet the trend of easing price pressures persists globally, as highlighted by the latest UK inflation report out this morning. Discover more in our “5 Things We Watch” below!

0 Comments