5 Things We Watch – SOFR Probabilities, USDJPY, CNY Devaluation, IFO & Eurozone electricity

Welcome to our weekly ‘5 Things We Watch’, where we as always zoom in on 5 of the things we look out for in global macro. The battleground in macro for Q2/Q3 looks to be found in Asian FX, where the USD wrecking ball has increased risk of policy action in both China and Japan, which would have significant implications for global assets.

This week we are watching out for the following 5 topics within global macro:

- SOFR Probabilities

- USDJPY intervention when?

- CNY Devaluation

- IFO

- Eurozone electricity

1) HUGE moves in SOFR positioning

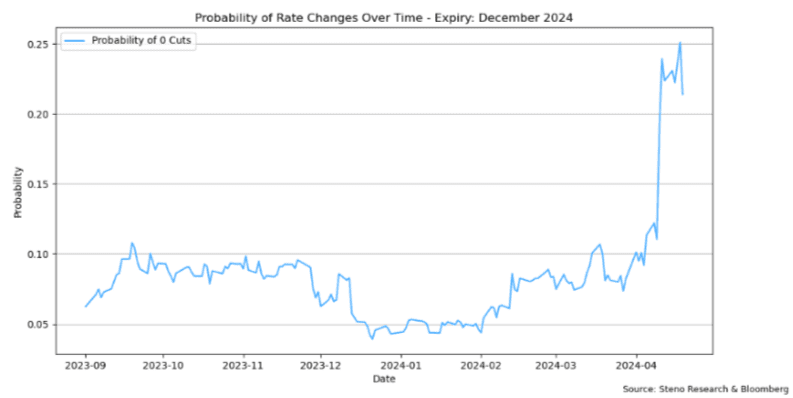

Option-implied probabilities for the December 2024 SOFR contract has seen a complete turnaround lately, indicating that markets are starting to acknowledge the reality of a more hawkish Fed than they had hoped for, after resisting to give up on the dovish narrative in Q1.

The outcome space for the SOFR-level at the end of the year has become much thinner, and the extreme scenarios of 3-4 cuts have more or less disappeared, and the battle is now whether it will be 1 cut, no cuts at all or even a hike, which are the most probable scenarios according to markets.

Chart 1.a: 0 cuts looking more and more likely

Equities are back to winning ways, while USD rates traders agree on 0 cuts this year being a probable scenario. Meanwhile, China is likely preparing for a devaluation of the CNY, and the intervention risks in JPY pairs increases, and the next macro battle in 2024 will likely be found in EM.

0 Comments