5 Things We Watch – Meeting Minutes, Cyclical Momentum, Natural Gas, Excess Retirements & China

The possibility of a comeback for both the manufacturing sector and inflationary pressures have reached the desks of macro enthusiasts, but markets have yet to fully acknowledge and factor in such possibilities, with initial bearish price action after both price releases being traded back within days, signaling that markets are still all about the direction of travel towards rate cuts.

Let’s dive right into this week’s 5 themes, and how to trade them!

This week we are watching out for the following 5 topics within global macro:

- Meeting Minutes

- Cyclical Momentum

- Natural Gas

- Excess Retirements

- China

1) Meeting Minutes

We see the FOMC minutes later as an obvious catalyst for a discussion on QT tapering in March, which could be a way for the Fed to sugarcoat a message of “high for longer” on Fed Funds due to recent incoming inflation data. The discussions on the Fed Funds path are mostly outdated due to the release of a couple of hot inflation reports in the meanwhile, why the largest signal value is probably found in the hints provided on the balance sheet.

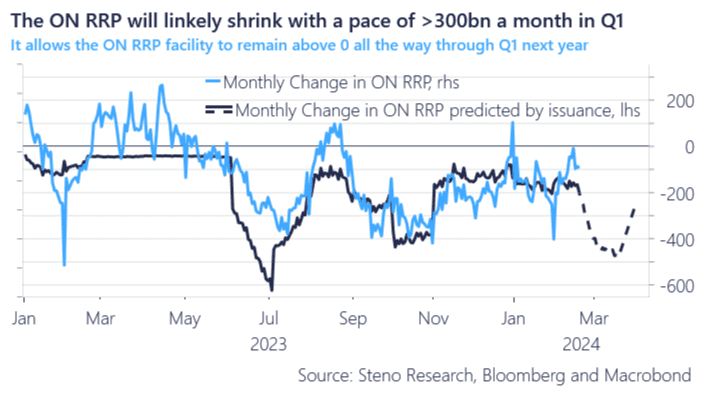

QT tapering is a strong tradeable trend in liquidity terms and we will write a follow up on how we trade it later today. Overall, we find the trend towards a more benign USD liquidity regime intact, which bodes well for liquidity sensitive trades such as Tech, even as the ON RRP depletion has admittedly slowed a tad compared to our base-case.

Chart 1: Issuance predicts lower RRP, but Meeting Minutes could change that

A possible return of cyclical momentum paired with inflation has caught the attention of macro enthusiasts, but markets continue to celebrate the promised cuts from the Fed. Will sentiment change with tonight’s meeting minutes? We elaborate on the 5 things we look at this week!

0 Comments