5 Things We Watch – Inflation updates, Labor Market, Oil, Chinese equities & Growth

Welcome back to another ‘5 Things We Watch’, where we cover some of the things we look at in the current macro landscape. This week will be all about inflation technicalities, as both BLS and Eurostat will update the inflation weightings for 2024 on Friday for US CPI and German HICP, respectively.

The US is looking VERY solid when scraping the headline numbers on everything from the labor market to PMIs, but some of the strength is simply manufactured in a spreadsheet, leaving us with an iffy gut feeling about what will come later this year.

In asset markets, we have an eye out for both oil and Chinese equities, as oil is back into the January price range after a quick visit above 80 USD / barrel, while the latter looks extraordinarily cheap fundamentally, but problems in China keep providing headwinds.

Read along as we give our two cents on the topics below.

This week we are watching out for the following 5 topics within global macro:

- Inflation updates and revisions

- Underlying weaknesses in the labor market?

- Why is oil acting weird?

- Time to buy Chinese equities?

- Where was the recession in the US?

1) Inflation updates and revisions (US)

BLS will update both spending weights and seasonal adjustment factors (for the period 2019-2023) on Friday, and while the seasonal adjustment factor updates will likely be negligible, the updates to spending weights could mean something for inflation dynamics (and thereby Fed policy) in 2024.

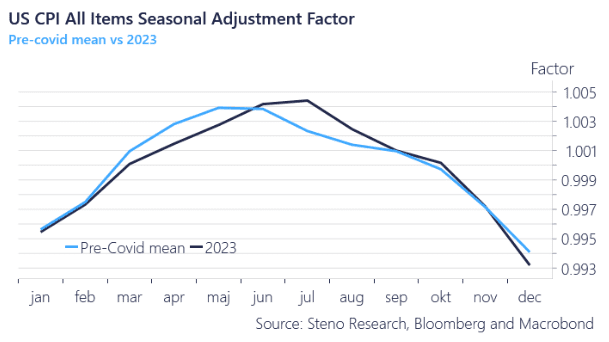

While US economic data to a large degree has been impacted greatly by outrageous seasonal adjustments post-covid (mainly due to the outlier filter in the SA models), economists in the inflation machine room haven’t suffered from the same seasonal adjustment issues as those working with labor market and other economic data have. The seasonal factors in 2023 moved more or less in tandem with the historical pre-COVID mean, hence why we don’t expect any surprises on that front Friday.

The updates to the weights based on spending data is much more interesting. Using BEA PCE data as a proxy for the CE for available categories (which are released monthly compared to CE data which is released annually) we are able to present preliminary insights into which weights that will be updated the most, and in which direction.

In real terms, there was a large decline in food consumption in 2022, while other CPI categories like Energy and Health Care showed an increase in consumption volumes. In general, services look to have a larger weight in 2024, while the opposite holds true for goods. If services inflation is on its way down that’s good news for disinflationistas, but inflation could also turn out more sticky next year as a consequence (especially if we are right that inflation will re-accelerate)

Short-term, this is net/net dovish as the housing category will continue to disinflate. It is probably time to receive in USD interest rates ahead of March.

Chart 1.a:

The BLS will update inflation weights and seasonal adjustment factors on Friday, the labor market is still strong but weaknesses are emerging, oil dropped back below 80 despite solid fundamentals, Chinese equities look cheap and the US is nowhere near a recession (for now). We will cover it all today.

0 Comments