5 Things We Watch – Inflation, Fed pause, labor market, Swedish RE and AI

Today has FOMC written all over it, which influences the topics we are most attentive to, and hence which five we’ll cover in this edition of the ‘5 Things We Watch’. Depending on the eyes observing we had a dovish CPI come out yesterday, which clears the way for J. Powell and co. to stay the restrictive course, but markets are pricing in an almost 100% probability of a pause – or skip if you will.

Besides inflation and the corresponding Fed reaction function, we will dive into the following:

- Waning inflation

- Fed pause

- Labor market

- Swedish real estate

- AI melt up

Let’s get to it.

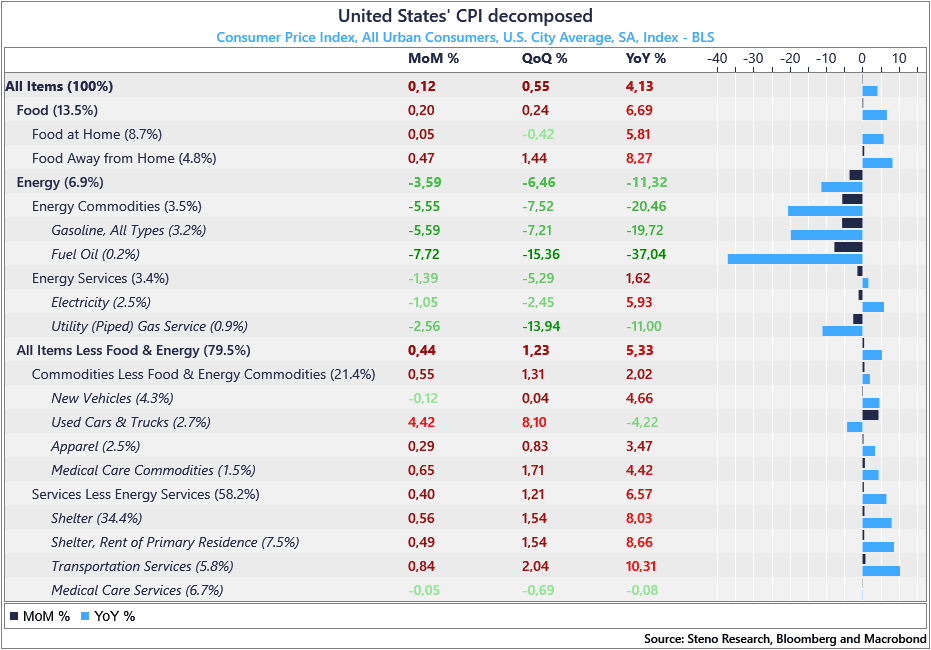

A dovish US CPI print yesterday

The CPI report was a mixed bag of goodies, but we are still confident in our 3–4-month projections of crystal-clear disinflation. Admittedly, spot inflation still leaves room for interpretation for policymakers, and we cannot rule out a rate hike from the Fed today based on current spot inflation pressures.

The glass-half-full type of analyst will claim…

Chart 1: US CPI decomposed

As is the custom every Wednesday, we will take you through 5 selected themes in the macro which we follow closely and summarize how we interpret them – this week spanning from today’s FOMC meeting to Swedish real estate.

0 Comments