5 Things We Watch – EUR-Inflation, Central Banks, The Business Cycle, Positioning & Commodities

Welcome to our weekly ‘5 Things We Watch’, where we take you through 5 of the things we look out for in global macro. With markets hawking up Fed expectations, Euro Area inflation surprising on the downside, and commodities breaking out technically, there are plenty of things to shed some light on!

This week we are watching out for the following 5 topics within global macro:

- EUR-Inflation

- Central Banks pricing

- The Business Cycle

- Fixed Income Positioning

- Commodities

1) Don’t worry about getting outhawked by the Fed, Lagarde!

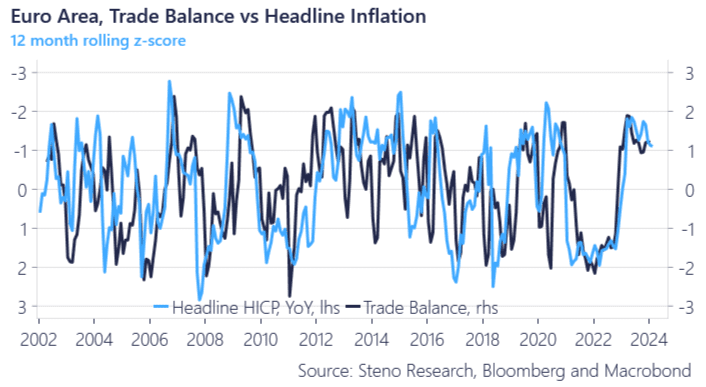

As we approach the commencement of the ECB (And the BoE for that sake) cutting cycle, given the outlook of soft data prints over the spring, EUR-hawks are coming out and sounding the alarms that cutting before the Fed will spike inflation, given the widening spreads in real yields. Looking at chart 1.a., We see that the trade balance in the Euro Area plays an important role, and there is certainly an argument to be made that by lowering rates, the real rate spread will be offset by stronger exports.

There is something for the hawks to worry about though, namely the latest rise in energy prices, which historically correlate well with both the trade balance and headline inflation given our energy dependency in the Euro Area towards non-Euro countries.

Chart 1.a: Monetary policy in the EZ: Keep a trade surplus and you won’t get inflation

Markets find themselves at a crossroads as the US economy is doing better than feared, while inflation is not acting the way the Fed hoped for. Meanwhile, European disinflation continues, which paves the way for larger divergences between central banks.

0 Comments