5 Things We Watch – BOJ, JPY, Treasury, Equities & Portfolio

1) YCC flexibility from the BOJ and more JPY weakness to come?

The BOJ has taken small steps towards a tighter monetary policy by allowing for a more flexible yield curve control. The new flexbility around the reference level at 1% properly means rates in Japan will be allowed to also slightly cross the 1% level.

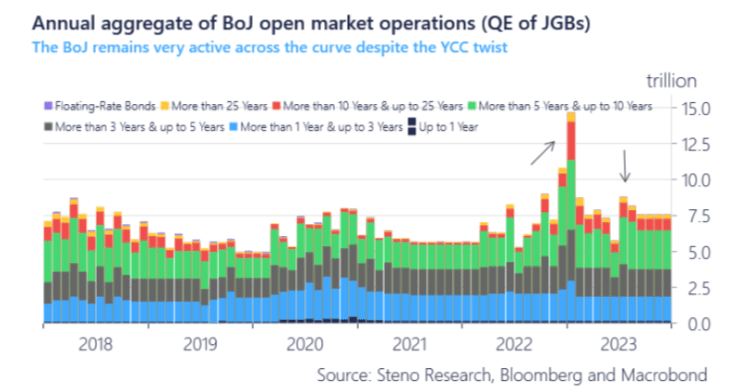

When the BOJ lifts the YCC cap they typically follow it up with heavy doses of QE buying to control the pace of the move in the yield curve just as we have highlighted in the below chart (See arrows). This is exactly why another increase in the YCC cap can be construed as JPY negative news if the BoJ again increases the balance sheet relative to peers to try and control the developments.

Chart 1: More BOJ buying to come

This week’s 5 Things has a strong focus on Japan and the BOJ while it also touches on the equity market and lends the reader a look at our portfolio.

0 Comments