5 Things We Watch: BoJ, Germany, Commodities, Canada, Inflation

This week we are looking at the BoJ hiking rates for the first time since 2007 and its effects on the Japanese economy. Afterwards we will have a look at the improving sentiment in Germany and then at a dive into the commodity rally currently underway. The we’ll talk about Canada where rates finally look to be impacting the economy and then we’ll end up with a short look at US inflation expectations.

This week we are watching out for the following 5 topics within global macro.

1) Buy the rumor, sell the fact in Yen

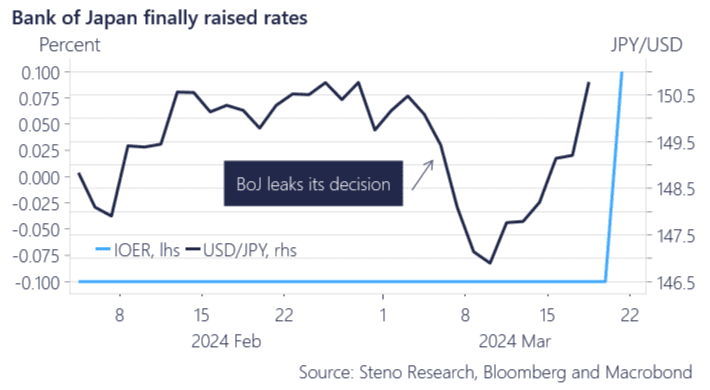

It finally happened. BoJ said goodbye to NIRP. This is screaming buy the rumor sell the fact with USD/JPY having gone through 150 levels after trading at 146 last week when the BoJ decision was leaked last week by Reuters. Bolstering this argument is the behavior of the Nikkei, which has returned to trading levels seen before the rates decision.

Additionally, the Bank of Japan opted against intervening in the Japanese equity markets through ETF purchases last week, even when the Nikkei experienced a sell-off due to rumors about the rate hike. This marks a significant departure from their latest standard operating procedure, which involved purchasing ETFs whenever the market dropped more than 2% in a single session.

We are not convinced that JPY can weaken a lot further from here (due to the mere intervention risk), while Nikkei looks toppish on all of our models.

Chart 1: Buy the rumour, sell the fact?

Welcome to another edition of 5 things we watch where we take your through the 5 most important things that we have on the radar.

0 Comments