5 Things We Watch Ahead of the FOMC Meeting

Today’s ‘5 Things We Watch’ will center around tonight’s FOMC meeting, which will not be any surprise to markets looking at the interest rate decision itself, but the Fed is in a difficult position in regards to addressing the path for Fed Funds in 2024, and the rhetoric later today will be key. Powell promised 3 cuts in December, but market pricing is increasingly leaning towards no action from the Fed, likely forcing him to pivot from his pivot.

With the Fed’s position as the big brother in central bank space, the choice of rhetoric will not be an easy task, as the ECB / BoE is hopefully waiting for the Fed to lead the cutting cycle to avoid balancing FX risks on top of inflation, and hawkish rhetoric from the Fed – although probably required to get financial conditions back under control again – could put fuel to the fire in Asian FX.

These are the 5 things we watch ahead of tonight’s meeting:

- How bad will sentiment get? Some insights from our sentiment tracker

- Will Powell lean towards 2025 for the first rate cut? Unlikely due to the US election, but there is a chance..

- The underlying economic momentum will not make the task any easier..

- Markets are jumping into extremes in Asian FX

- Tightening is already taking place in liquidity space, which could make for a more dovish message later

1) How bad will sentiment get in 2024?

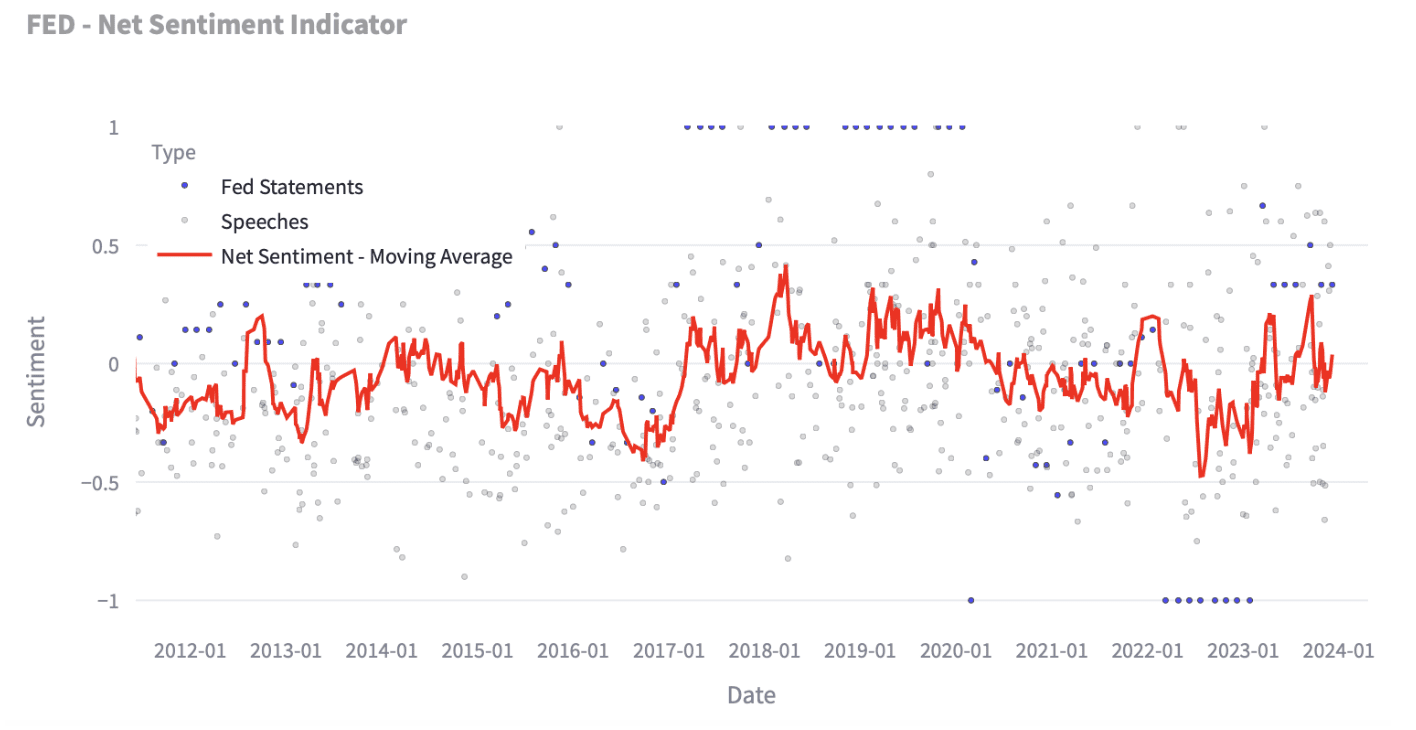

Our proprietary central bank sentiment tracker has started off the year neutral, despite the dovish FOMC meeting in December.

Since the start of the year, multiple FOMC members have been required to turn more hawkish to regain control of markets and financial conditions in their attempt to control renewed price pressures, and we’ll be watching closely to which extent the Fed will approach the hawkish sentiment score of around -0.5 points from 2022. There are plenty of indicators pointing towards such an approach being the result if 0 cuts will indeed come into play, but given the urgency for monetary policy to normalize in an election year, there are arguments for holding a dovish lean, even when push comes to shove (inflationary pressures resuming).

Chart 1: How hawkish will the Fed turn in 2024?

Tonight’s FOMC decision will likely come as a surprise to markets, but the rhetoric and possible acknowledgement of market pricing will be key. We provide 5 things that we look at to understand the situation the Fed has placed themselves in.

0 Comments