5 Things – Inflation Divergence, China, Euro PMIs, NIkkei and Suez

1) Inflation comeback in the US?

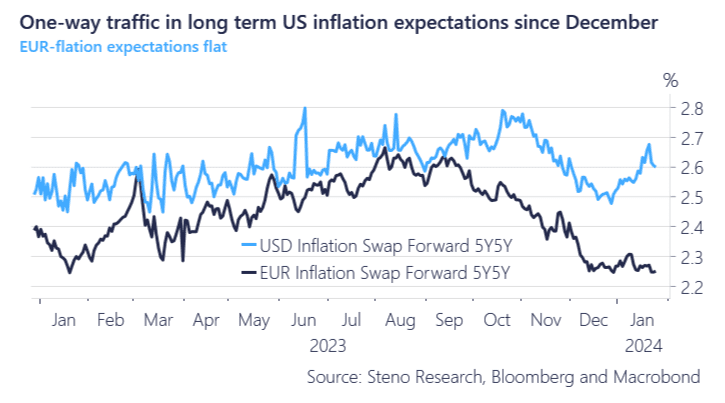

The last month of 2023 really showcased markets’ proclaimed inflation victory, with the Fed and other central banks promising rate cuts, disinflation trends continuing and equity prices rocketing, but the disinflation might be over, at least in the US as risks of higher inflation have been anchored in expectations.

Judging from relative inflation swaps, we have now exited the inflation convergence regime for 2022/2023 when markets convinced themselves that the inflation embeddedness was as much a European thing as it was an American thing.

We are getting increased evidence of the opposite now with less stickiness in housing inflation, wage growth and similar underlying gauges of inflation in Europe compared to the US.

The inflation market has started to diverge accordingly, and we find that markets will have to increase the probability of EUR-flation returning to the sub-2% era again ultimately.

Conversely, USD inflation swaps have started to increase the risk of embedded USD inflation and a structural level above 2% for the CPI growth, which we mostly concur with.

Chart 1: Inflation comeback in the US?

This week in 5 Things We Watch we are honing in on US vs EUR rates/inflation, China stimulus, Euro PMIs, Japanese equities and the Suez troubles.

0 Comments