Scandi Watch: Stay long NOK (and pay NOK rates) into Norges Bank

As Norges Bank gears up for its upcoming meeting on Thursday, all eyes are on the new rate path. It’s widely expected that the central bank will maintain its current rates, putting the spotlight squarely on the future direction of rates. Here’s what we can discern from the key components feeding into Norges Bank’s rate path model ahead of the decision.

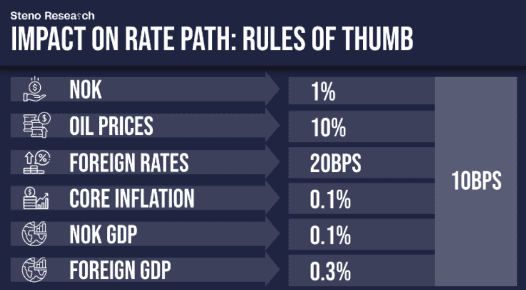

Remember that you can live-proxy Norges Bank rate path via this cheat-sheet. In the below we will show why the developments have been net neutral or even slightly hawkish since March in Norway, in contrast to Sweden. We remain long NOK/SEK into the meeting.

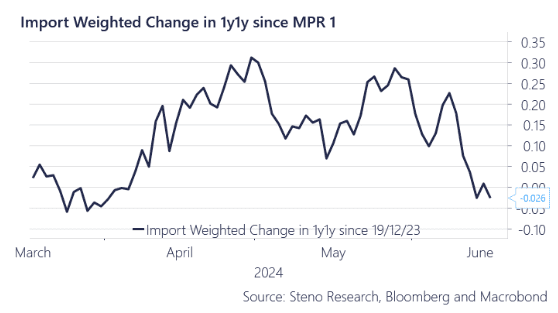

- International Rates: Minimal Change, Minor Hawkish Revision Possible

The I44 weighted rates have moved little since the MPR 1 in March despite volatility in between. This stability suggests that there should be no significant changes to the rate path due to international rates. However, given the cut-off date nuances, there’s a possibility of a slight hawkish revision, estimated at around 3-4 basis points.

The net developments in Norges Bank rate path model suggest that Norges Bank will remain patient. Not much has changed since March. This is net hawkish relative to market expectations.

0 Comments