Positioning Watch – There was no “rotation” from large to small caps

Welcome back to our weekly positioning update.

It’s hard not to touch upon the recent moves in equities once again, with markets trying to digest whether it was the beginning of a broader outflow from large cap / tech into small cap stocks and indices like Russell 2000, or if it was simply a hiccup due to extended positioning and a profound fear that the cutting cycle was already fully priced in, leaving tiny room for extensive gains in large cap stocks, which were up >20% YTD before the CPI report. We provide 3 reasons as to why it was not a rotation below.

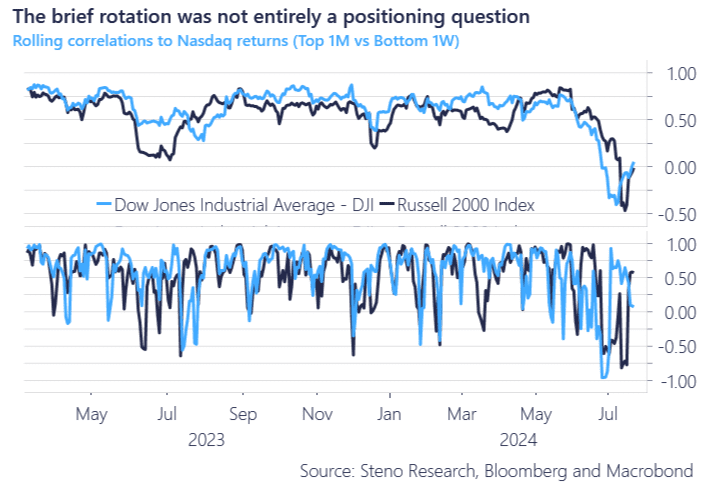

As always, this is more complicated than a simple chart or two, but from what we can observe in data, it was likely the culmination of 1-2 months of extreme concentration and positioning in large cap market-weighted indices. The correlation between Nasdaq and Russell / Dow Jones returns has been decreasing extensively from late May / early June, and the events on July 17th was probably a result of just that: Markets normalizing positioning by taking off some large cap risk and getting rid of some small cap shorts.

There are however few signs that the slowdown will continue, with earnings expectations still elevated, both for the ongoing Q2 earnings season and the rest of 2024. Markets are not positioned for a recession in equity space (but maybe in fixed income space) from what we can see, and hence we don’t see the idea of chasing one.

Reason 1: The “rotation” was just markets normalizing positioning

The equity scare seen throughout July with Nasdaq losing terrain against Russell was likely not the beginning of a longer rotation from large to small cap, but rather normalization of extreme positioning. Markets are still heavily long large caps, while the Russell bid is slowly vanishing.

0 Comments