Positioning Watch – The soft landing is moving towards a recovery trade

Hello everyone, and welcome back to our weekly positioning watch.

The debates about whether the US is heading for a recession are still touring the charts, as the labor market and other economic data soften back towards pre-pandemic levels. However, while some might be uncomfortable watching the US economy slow more than anticipated, the lack of ringing alarm bells and Powell’s recent victory lap on inflation have greenlighted markets to price in a soft landing as a 95-99% probability event by now when looking across positioning data. You could even argue that the market has entered a “recovery regime”, where small-caps and rate cut bets (such as Homebuilders) are bought right, left and center.

Overall positioning and sentiment indicators are starting to diverge, though. Most indicators show continued support for risk assets in H2, and we have not seen any major positioning moves from Hedge Funds over the past weeks, despite a weak ISM services report and the assassination attempt on Donald Trump. This signals that recession jitters have yet to reach order books.

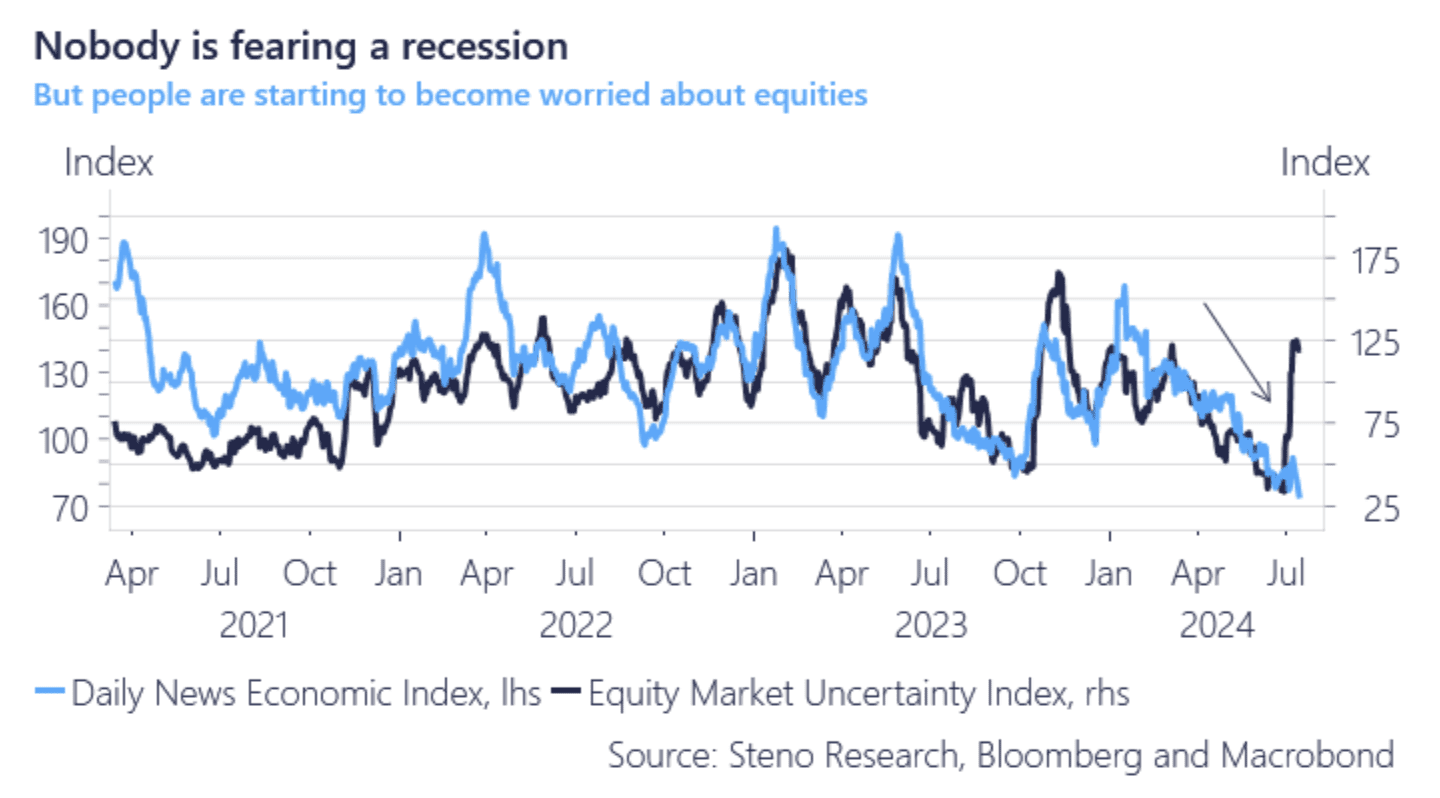

The elephant in the room is the diverging expectations for equity performance vs. economic consensus. Over the course of the hiking cycle, equity market expectations have generally been following economic expectations, but we are starting to see increased equity market uncertainty without a subsequent rebound in economic uncertainty.

Chart 1: A recession is not in the cards, but some indicators are blinking yellow for equities

Our positioning gauges show that markets fully price in continued equity momentum and 50 bps worth of rate cuts in H2, which means that markets will now need to find value trades elsewhere. There’s also substantial support from AMs towards the short vol trade, but watch out… Is this a recovery, a re-acceleration or a slow-down?

0 Comments