Positioning Watch – Markets are buying into US Fixed Income, but fast money don’t agree

Welcome back to our weekly positioning watch, brought to you today from a sunny Copenhagen.

Denmark advanced as the second team in their Euros group yesterday (barely), with England taking first place. This made most Denmark fans cheer until they realized we are playing Germany on Saturday. Meanwhile, Austria delivered a shocker, sending France through as second in their group.

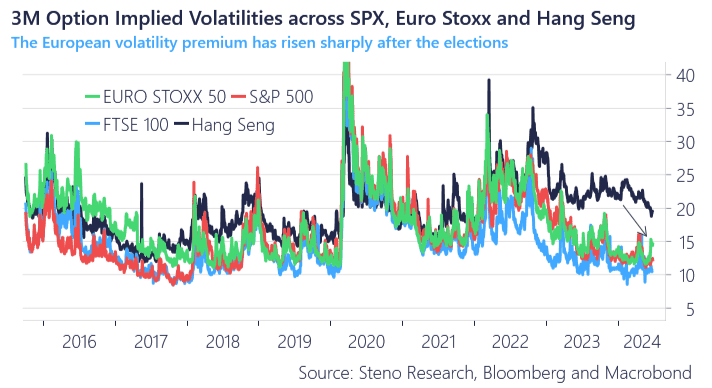

The standings at the Euros almost perfectly mirror the current cross-regional uncertainties in equity markets. The European election has increased the option-implied volatility premium of European equities compared to US equities, while the FTSE 100 continues to stay “less volatile” in IV terms. We are also starting to see what could turn out to be a significant reversal, with option-implied volatility on the HSI looking to break the plateau of 20-25, while US and European equities are starting to trend slightly higher.

Looking at a broader scale, it’s interesting to see the effects of global hiking cycles on equity implied volatility, with most equity indices moving in tandem up until 2022. After that, European and US indices continued to move alongside each other, in contrast to China proxies like Hang Seng, which has stayed elevated up until 2024.

Chart 1: Option Implied Volatilities across regions

The outlook for USD rates is turning increasingly soft given the latest soft inflation prints, and with PCE consensus Friday looking relatively soft, the trend will likely continue over the coming weeks. Do we agree? No, and neither does fast money.

0 Comments