Positioning Watch – Hedge Funds are leaning towards increasing growth, but NOT inflation

Hello everyone, and welcome back to our weekly positioning watch.

The sudden deflation in the Motor Vehicle Insurance component in the CPI report removed 0.05-0.06 pct. points from overall MoM price pressures in May compared to the report in April, where the same category rose 1.5% on the month.

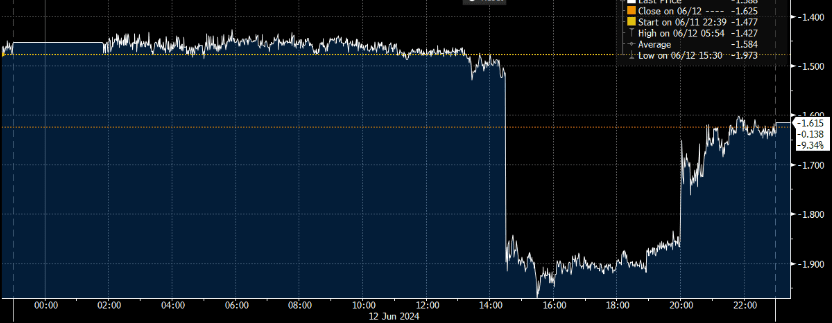

While the report was clearly dovish for Fed and asset pricing, the FOMC press conference, which was relatively hawkish compared to the CPI report with Fed revising their PCE forecast upwards while further postponing cuts, leaving 1 cut in 2024 in their projection.

The Fed’s message Wednesday does not align with overly dovish actions in 2024 if you ask us, and we hence still refrain from entering US Fixed Income bets, rather playing relative curve bets (which we do currently, paying SONIA while receiving EURIBOR).

Chart 1.a: Turbulent times in Fed pricing Wednesday (Number of Fed hikes priced in)

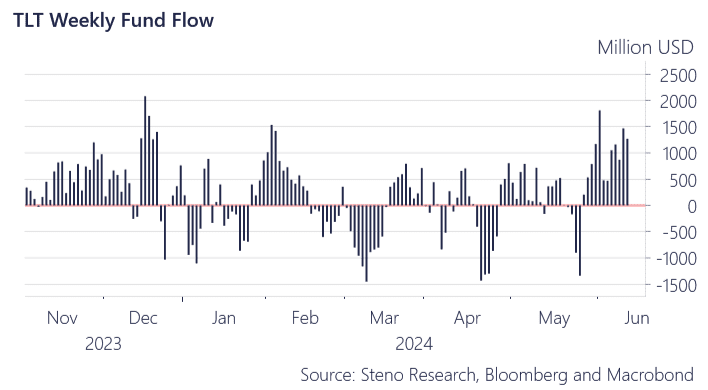

Chart 1.b: Investors still fancy US duration

There are no recessions in sight in positioning data, and it seems like markets are all in on the booming US story, on top celebrating the net dovish outcome of the CPI report and FOMC presser Wednesday.

0 Comments