Portfolio Watch – This NFP will allow September seasonality to unfold.

Happy Friday from Copenhagen!

This week has revolved around the NFP report from an allocation perspective, with markets being hypersensitive to employment-related data throughout. ISM Employment and Job Openings have once again become major players on the economic calendar.

Today’s NFP report was dovish overall, coming in below the consensus of 165k at 142k, with the July number revised down by 25k, offering little in the way of positive signs. The market reaction mirrored trends from early August, with an immediate pricing in of a 50-60% probability of a 50bps cut across the remaining three FOMC meetings in 2024. This led to heavy buying at the front end and a sell-off of the dollar. However, as we expected due to the heavy positioning towards a soft print, a knee-jerk reaction followed. Everything unfolded more or less as planned.

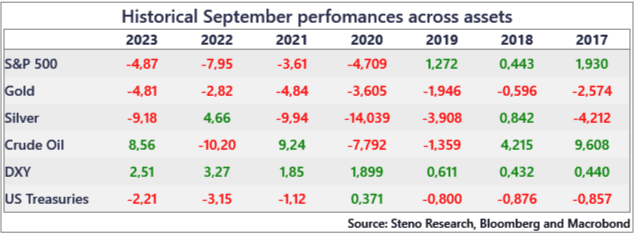

The bottom line is that the service sector is not yet weak enough to fully support the 50bps cut narrative, and with a potentially hotter inflation report next week, we think it’s increasingly likely that the typical September seasonality will take its course.

Equities are down, rates could move slightly up, precious metals are down, and so on…

Chart 1: September seasonality in recent years

With the lukewarm NFP report out, we share our portfolio watch, update you on last week’s allocations, and offer some thoughts on where assets may be heading next!

0 Comments