Portfolio Watch: Markets discarding Q2 data due to Dudley?

Welcome to the weekly Positioning Watch, where we assess the past week’s performance of our portfolio.

We have generally navigated a tricky week well, thanks to material gains from our metals shorts. However, we are admittedly a bit surprised by the lack of response in the rates space to what appears to be a still-resilient US economy. We are still up 20% since our launch in May 2023, in a portfolio that is essentially uncorrelated with the S&P 500, which is something we are proud of.

Fair enough, the Q2 GDP report and the upward surprises/revisions to PCE numbers are somewhat old news, but they still defy the gravitational pull towards 2% inflation and sub-trend growth that markets have been chasing for a couple of years in the rates space.

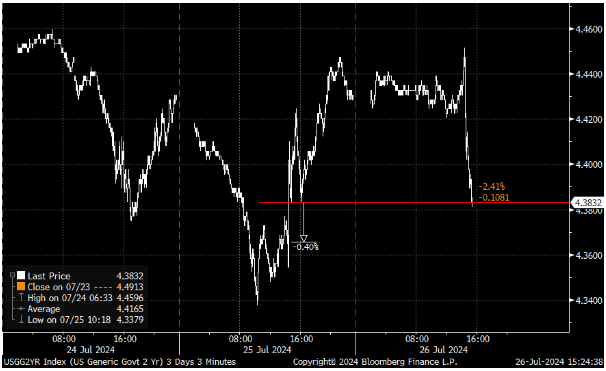

We are now back to trading below the front-end rates levels seen before the smoking-hot US GDP report. Does that make sense, or are markets starting to lose their composure ahead of the July FOMC meeting?

Markets are pricing in -26 bps for the September meeting, which is the first sign that we are likely to discuss a 50 bps cut in September at the first sign of weakness in the US economy going forward.

Chart 1: 2yr rates below levels seen ahead of the GDP report

The market is hellbent on pricing in cuts, even when the data is hawkish. This is an interesting dynamic and the FOMC/BoJ meetings next week will be key to gauging the trend from here. Maybe markets have just ignored anything but crazy Bill Dudley this week?

0 Comments