Portfolio Watch: Is this US slowdown in the room with us right now?

This week’s economic updates paint a mixed picture from around the globe, but we continue to capitalize strongly on the volatility in our alpha portfolio.

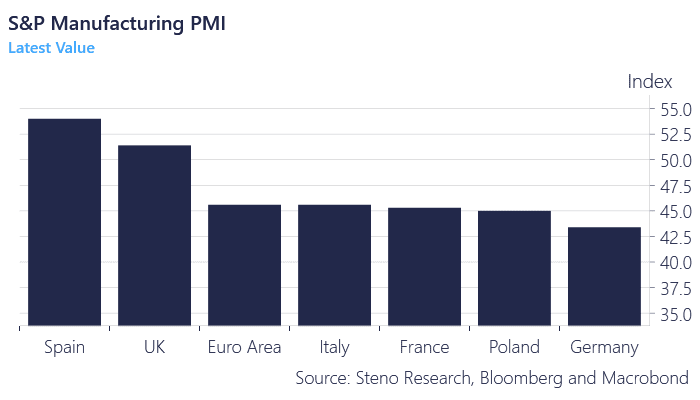

In Europe, while recent PMI data suggests a downturn, high-frequency indicators like electricity consumption hint at a possible rebound in industrial production.

Looking at European PMI numbers from this week, the bad news from last week’s French election turmoil continues. In general, the Euro Area’s manufacturing PMIs are struggling, with Germany looking particularly bad. However, the PMI numbers are becoming more and more of a lagging indicator. If we hone in on Germany, we see that high-frequency indicators such as realized electricity consumption suggest improving industrial production. Therefore, we continue to work with a Gung Ho/Goldilocks scenario for July and ignore the bearishness.

The US PMI release made for Goldilocks reading, with activity running at a 26-month high, while output prices dropped to a 5-month low (though still above long-term averages and inconsistent with 2% inflation). This bodes well for our bet on the US consumer into July.

Chart 1.a: PMIs look bad

The US exceptionalism was once again solidified with the release of the PMI numbers. While we don’t find a lot of forward-looking signal value in S&P PMIs, it’s still fair to ask whether the slowdown is even happening.

0 Comments