Portfolio Watch: Buy Bonds, Wear Diamonds (or Gold)?

We’ve generally experienced a “softer” September than anticipated in terms of interest rates. The typical September issuance seasonality takes a back seat to the upcoming first Fed cut in this cycle. Nick Timiraos has hinted that some officials are seriously considering going big already next week, so we may be in for a ride.

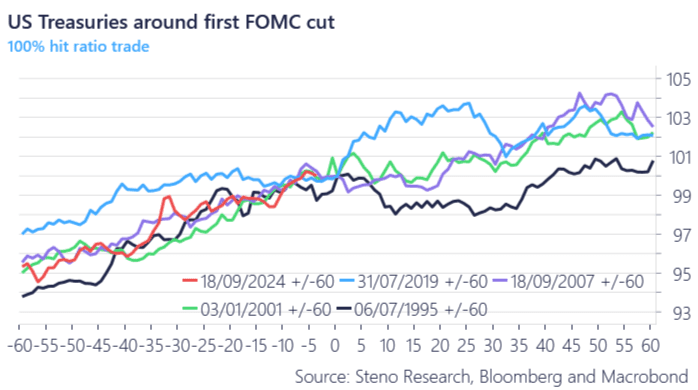

On a trend basis, it’s typically unwise to bet against a cutting cycle in Fixed Income around the first rate cut. Historically, it’s been a nearly 100% successful strategy to buy bonds and wait it out – from 60 days before to 60 days after the first cut.

There’s probably no need to make it more complicated than that in the current macro environment, where growth, inflation, and liquidity are all declining simultaneously. In early September, liquidity fears led to sell-offs even in silver, Nasdaq, and other asset classes that usually benefit from lower bond yields. However, that trend has since stabilized.

We’re still facing liquidity withdrawals due to corporate tax deadlines and quarter-end window dressing by banks, which may haunt us next week.

Chart 1a: US Treasuries around the first cut

A portfolio needs a “soft USD rates” lean to perform in the current environment, a dynamic often seen around the first Fed rate cut. Here’s how we plan to reshuffle the portfolio.

0 Comments