Out of the Box #15: What if its the labour market that drags housing down this time?

Main Points:

1) The US economy is looking strong for now. Crude drawings and solid job numbers keep coming in etc,

2) My view is we will see a recession around Q1 and that layoffs will be manifested in small buis/service sector

3) The FED and the Treasury will have a harder time responding this time around given less fiscal and monetary room making a bailout of relevant creditors costly

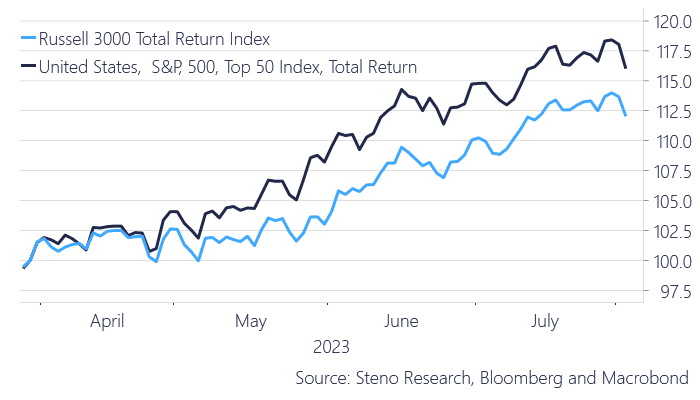

In my inaugural piece (available here), I highlighted an economic climate of distortion, with winners and losers due to the monetary policy regime and yield curve inversion. I argued that strong businesses with robust balance sheets would emerge victorious over smaller local businesses, startups, private equity, and the like.

Or to rephrase my exact wording for favorable trade dynamics:

“Long solid finances and big CF vs short burners

Long big service vs short small industrials

Long-quality liquid assets vs short illiquid duration etc”

It is satisfying to see that the assessment has matured quite well as far as performance goes. Equities have admittedly gone through quite a bubblish streak overall and the AI hype distorts this chart but nevertheless, we see a clear overperformance among the big players:

Chart 1: S&P 500 vs Russell 3000 (since article)

All recession calls have been mistimed so far but I think the end is near for our booming economy and that the “real economy” will be the first domino before the financial system despite the obvious issues within it

0 Comments