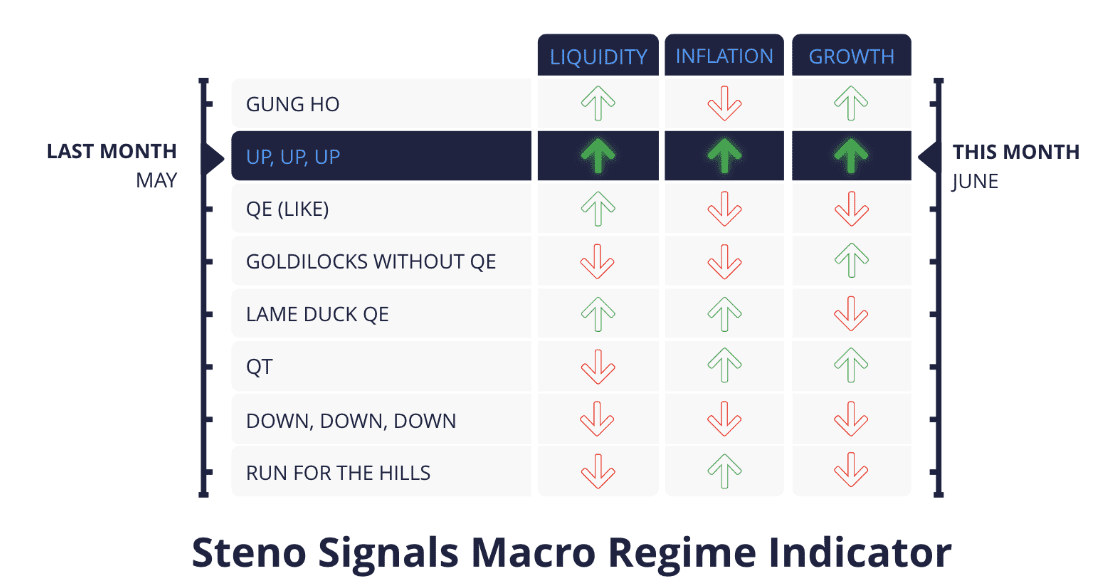

Macro Regime Indicator: Up, Up, Up still!

In May we concluded that: “In May, our models hint of an “Up,Up,Up” environment in inflation, growth and liquidity, which is a decently positive indicator for risk assets, but also for broader reflationary trades returning through the month and into June.”

The above conclusion has held true to a large extent and we went against the prevailing consensus driven by the “slowdonistas” when needed during the latter parts of April.

For June/July, we see an increasing liquidity trend from right about now, while the growth- and inflation cycle cyclically heats up still, while some lagged effects pull in the opposite direction. From a market perspective, the overwhelming conclusion is that we will continue in an up, up, up macro regime referring to the liquidity cycle, growth cycle and cyclical price/inflation cycle.

The biggest “risk” to the above view is currently that we enter a scenario with rising liquidity, slowing inflation and improving cyclical growth at the same time. Goldilocks, anyone?

Welcome to our monthly flagship asset allocation analysis – the “Macro Regime Indicator”.

Growth: Bellwether economies showing positive signs

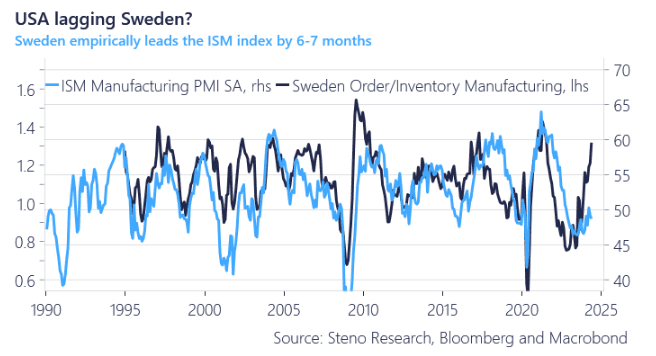

Recent economic data indicates an optimistic shift from the bearish trends observed in April/May. Key cyclical economies show signs of improvement, with Sweden’s PMI for orders and inventory suggesting positive momentum for ISM manufacturing in months ahead. We still find a very decent risk/reward in betting on an improving cycle in both the US and Europe.

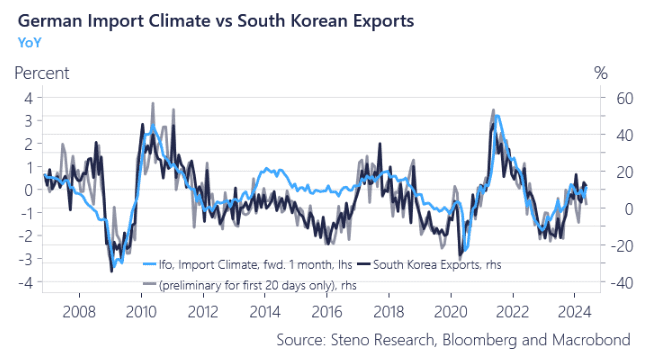

Seasonal adjustments also continue to skew these growth gauges favorably in the coming months. Additionally, with the steady trade flows between Europe and Asia, despite ongoing supply issues, there are no reasons to suspect an immediate growth decline which had otherwise been put on the table by many pundits over the last weeks.

Chart 1: Sweden paving the way for the US cycle?

Chart 2: An improving cycle in two cyclical economies such as Germany and Korea

More macro positivity after the month of May with both ups and downs in data print. The tide is turning on a couple of the major inputs in our Macro Regime model.

0 Comments