Macro Regime Indicator – Growth is the dark horse in July..

Coming into June, we wrote that the biggest “risk” was that we moved towards a goldilocks scenario. While our portfolio returns have mostly mirrored that regime (outside of Crypto), we have to admit that the growth component of the equation has slowed somewhat relative to our model base case. We reassess the picture on a macro level and on a quant basis in this analysis.

While we are not convinced of the general US recession call making the rounds in the wake of the poor ISM Services report, our forecasts for the coming month place us into the ‘QE (Like)’ regime bucket – Growth lower, Inflation lower and Liquidity higher.

That said, our slightly rosier view on Growth (compared to consensus) does also lead us to consider and balance this against asset performance in the ‘Gung ho’ regime (Growth and Liquidity higher, Inflation lower). You can look for this to be approached more formally in our future Macro Regime methodology. As ever, both the Regime Model and the related Structural Asset Allocation Models we rely on here are available on the DataHub.

Before moving on to the quant-based observations in the current macro regime, let’s briefly touch upon the base case for growth, inflation and liquidity in July.

Growth: Flatlining..

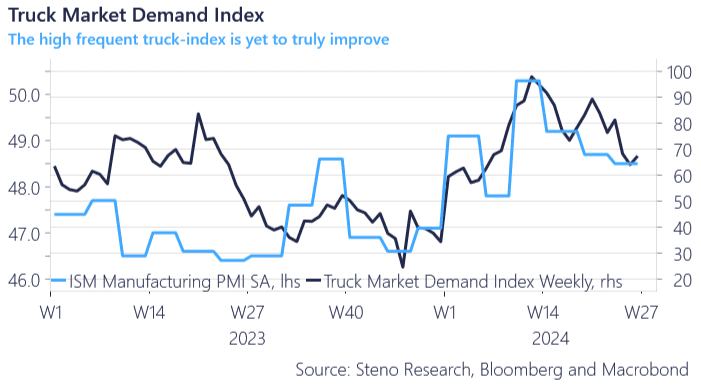

The beginning of July has seen a weak influx in tax revenues, truck-market data, and related economic indicators. The cyclical momentum, which had shown strength earlier in the year, has now stagnated, suggesting that the ISM Manufacturing Index will remain below 50 for the foreseeable future. Projections for July indicate a reading around or just below 48, marking a further sequential decline from June. While this downturn isn’t drastic, it highlights a lack of robust momentum in U.S. economic cyclicality at present.

Chart 1: Cyclical growth moving nowhere in July

The growth input has started to turn shakier in the US, and our high-frequency indicators have flatlined for July. Inflation is softening (before a potential revival in H2-2024), while liquidity is improving. Here is what it means for markets..

0 Comments