Liquidity watch: Two major waves of liquidity left this year of varying quality

While we are waiting for Godot and US inflation, we have examined the liquidity outlook for the remainder of the year. I have had numerous discussions with social media macro pundits who have “democratized” the net Fed liquidity measure and treat it as gospel for predicting daily flows in risk assets.

The short answer is a resounding no. We must remember that liquidity is a byproduct of fiscal and monetary policy decisions. Therefore, the important part of the analysis is to understand why liquidity is moving, not just if it is moving.

Depending on the type of liquidity additions/withdrawals, the quality of the liquidity signal improves/worsens as a driver of asset markets. We rank the largest liquidity items by importance in the following order. The higher on the leaderboard, the more “permanent” the liquidity is.

1) SOMA-holdings (QE)

2) ON RRP

3) BTFP / Discount Window

4) TGA

Let’s have a look at the details.

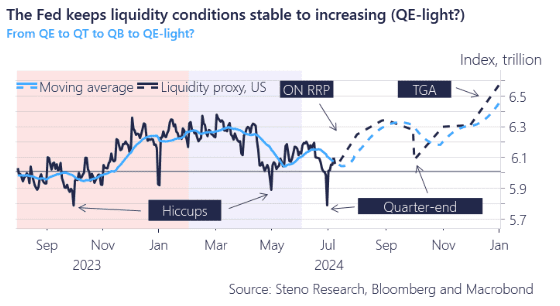

Chart 1: The liquidity outlook looks solid for 2024

The first wave of liquidity will arrive over the coming 6-8 weeks via a continued depletion of the ON RRP facility. We consider this a “high-quality” addition to the liquidity pool due to it’s semi-permanent character, and as actual deposits in the real world are added along the way.

When a money-market fund buys a t-bill issued by the US Treasury, a net deposit of the same size will be added in the real-world, once/if the US Treasury spends the USD instead of parking it on the TGA. Given that we are within spitting distance of the target level on the TGA, the Treasury issues to spend over the next 6-8 weeks.

Over the course of July, the U.S. Treasury anticipates returning short-dated bill auction sizes to levels at or near the highs observed in February and March.

This expected increase in bill issuance is projected to lead to a marked depletion of the ON RRP facility in July and August, bringing its levels closer to the de facto floor. While firm evidence is still pending, preliminary tests suggest that the true floor level for the ON RRP could be several hundred billion USD below the current levels.

The upcoming six weeks will be crucial in testing this hypothesis, as the market adjusts to the increased net issuance of Treasury bills.

In this primer on USD liquidity, we aim to discuss why and when liquidity matters, and also highlight the two major drivers of liquidity until New Year’s. Liquidity will continue to improve.

0 Comments