Labor Watch: This doesn’t exactly scream recession (yet) …

Take aways:

- This currently looks more like normalization than weakening

- More fuel to the story of an income driven cycle

- The productivity / disinflation story of ‘23 likely a hoax

- The post Covid labor market has been especially good for low skilled workers

Welcome to this short labor market watch on the back of this week’s NFIB and CPI numbers. Currently the labor market has softened considerably from tight conditions in 2022, yet there is still some time before this slowdown potentially leads to a recession. From the NFIB numbers we already got more hints of the deflationary trends suggested by this month’s CPI report as price plans continue their decrease.

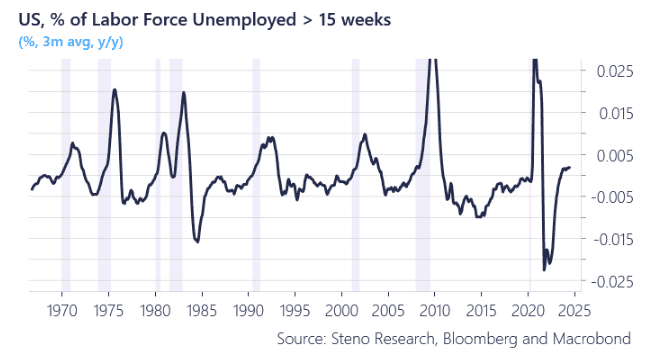

Chart 1: Currently this looks more like normalization than recession

Take aways: This currently looks more like normalization than weakening More fuel to the story of an income driven cycle The productivity / disinflation story of ‘23 likely a hoax The post Covid labor market has been especially good for low skilled workers Welcome to this short labor market watch on the back of this week’s NFIB and CPI numbers. Currently the labor market has softened considerably from tight conditions in 2022, yet there is still some time before this slowdown potentially leads to a recession. From the NFIB numbers we already got more hints of the deflationary trends suggested by this month’s CPI report as price plans continue their decrease. For more on the CPI release, you can find our breakdown here. Chart 1: Currently this looks more like normalization than recession From the dashboard below our main takeaway is the lack of recessionary vibe that pockets of the market are screaming about. The optimism index has been rising over the past quarter and inflation is still looking like a far greater threat to small businesses than interest rates. Also noticeable is the drop in price plans for the next 3 months which has been grinding lower over the last quarter fueling the disinflationary story in the US… Small businesses giving Powell the green light to start rate cuts if yesterday’s CPI report wasn’t enough? In the job component there’s a notable disparity between job openings and employee compensation, with the gap reaching its third lowest level since 2000. […]

0 Comments