Evergrande Nugget: Popping the World’s Largest Asset Bubble

Monday, a Hong Kong court ordered the liquidation of Evergrande- whether the court ruling will be of much help to creditors remains to be seen as the court’s jurisdiction is separated from the bulk of Evergrande’s assets located in the Mainland.

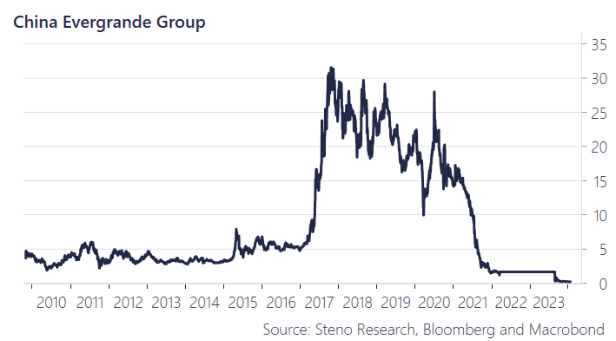

This ruling doesn’t come as a surprise to the markets, as Evergrande’s impending bankruptcy has been public knowledge for months. Beijing has displayed little inclination to rescue the world’s most heavily indebted real estate developer, burdened with an astounding $300 billion in total liabilities- a fact that has been reflected in the now-suspended Evergrande share price.

We are not overly worried about this development and we’d like to remind you that Evergrande was a “target” of the three red lines policy introduced in August 2020 as they breached covenants day 1. Evergrande’s downfall has largely been orchestrated by the Politburo. While the issue probably grew out of hand, the Chinese leadership is unlikely to truly pivot as they are playing the long game here, even despite substantial spill-overs to both international investments and local sentiment.

Chart 1: Evergrande Equity

While markets are hardly panicking about the court order 2 questions arise:

1. Can the Chinese leadership viably disregard foreign claims and anticipate any degree of success in improving foreign sentiment?

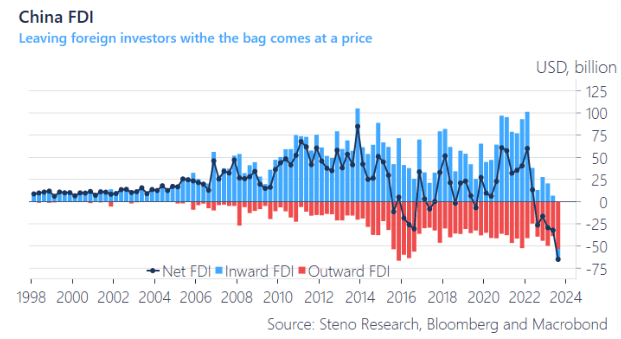

Indeed, the Chinese leadership faces a delicate tradeoff between attracting foreign investment by maintaining credibility with investors versus holding the Real Estate Sector on a leash

Chart 2: FDI

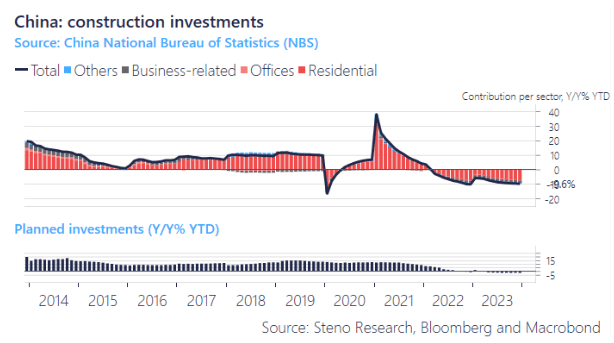

Contrasting the FDI chart above with the development in construction sentiment clearly shows that the flight of capital coincided with construction investments collapsing.

If the FDI is to pivot we would need major efforts from Beijing to buy back confidence and leaving creditors without claims certainly won’t help- on the other hand, Beijing could try to cut favors with off-shore investors but it would be a balancing act to do so without spurring more speculation into the existing debt malaise- and it is probably unlikely that paying creditors their due would do much for Beijing but sending more investments out of the economy.

The bottom line is that Beijing is unlikely to comply with the Hong Kong ruling in any meaningful manner and that liquidating Mainland Real Estate won’t attract much foreign interest at this point

Chart 3: China, Construction Investments

2. Will the Evergrande Bankruptcy have any bearing on the Chinese Real Estate prices going forward?

One thing is developer sentiment and the complete collapse in Real Estate investment- another is the actual price action in the existing housing base. On the surface, a layman may well ask why a lower supply wouldn’t be bullish for the housing market, and all else being equal that would indeed be the case.

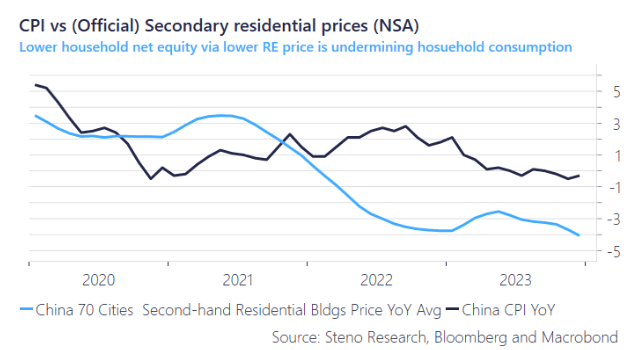

But we are dealing with the economic contagion of a speculative bubble where prices are widely detached from the fundamental (and unknown) price levels. Beijing’s efforts to rein in this situation are aimed at discovering and aligning prices with fundamentals, but this process takes time, and as shown in the chart below, the economic consequences are NOT negligible

Consumers won’t take on leverage or spend

Chart 4: CPI vs Secondary residential prices

It should be noted that Beijing seems more accommodative in addressing this problem than helping foreign creditors or failing developers, but the initiatives taken are still on the mild side and with limited impact: Easing loan rules and property-project financing and rolling back home-purchase curbs etc, do not address the actual driver behind the falling prices (which are probably more depressing than what the official data suggests).

As long as buyers expect prices to fall there is little incentive to buy and for owners to lever-up and spend/invest. Xi’s 3 red lines removed the floor from the market and we don’t see any pivot on

We think it likely that Beijing will be forced into more policy adjustments and stimulus efforts to balance out the effects of the above- something we’ve written about recently which is accessible right here (for subscribers only). We have also managed to time our China view successfully lately (see here).

Get full access to our entire research platform and our trading in real-time by subscribing right here

Evergrande has now formally transitioned from a state of de facto default to a legal liquidation. How will the markets and Beijing act to the latest ruling?

0 Comments