Equity Watch: Analyzing Rotation, Momentum, and Sentiment in the Equity Markets

Take aways:

- As liquidity and growth improve so will equity markets

- The RTY rotation story is not all rosy

- Momentum suggests that we are not as concentrated in equity markets as we think

Three weeks ago, when the dovish CPI print landed, the immediate reaction was a sell-off in large caps followed by an influx into small caps, with RTY rising >10% over the week following the release. Consequently, we have seen the dispersion trade scaled back, momentum factors in equities have had a tough couple of weeks, and investors have flocked to small caps expecting rate cuts to ease interest burdens. We have also heard many market commentators talk about dangerous levels of concentration, citing dot-com bubble levels.

In general, we are fading this rotation/concentration story, which the markets also seem to be doing by now, and we list the following arguments as to why:

Firstly we see a strong outlook for both growth and liquidity which have contributed to early signs of calmness resuming in equity markets and that naturally means that both the dispersion trade and momentum is back en vogue.

The biggest winners from a return of the momentum factor would be semiconductors, uranium & nuclear, NDX and finally RTY.

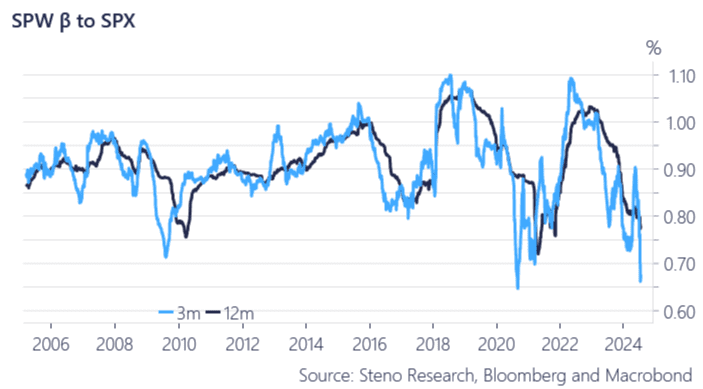

Chart 1.a: A 1% increase in the equal weighted SPW is now equal to a 0.65% gain in SPX

Are small-caps back in fashion or was the rotation short-lived? We have looked at various factors of relevance to this question and the conclusion is that you should not jump the bandwagon.

0 Comments