Energy Cable: More pain to come in copper, while Nat Gas is a long trade?

Take aways:

- China will flood markets with copper supply

- Copper har decoupled from macro fundamentals according to our PCA tool

- It’s a tuck or war between positioning and fundamentals in metals

- Crude tumbling despite all time highs in global flight data and crowded congestion

- Nat Gas is now a STRONG value trade on the long side

Hi and welcome to this week’s Energy Cable from a cloudy and gray Copenhagen.

Cloudy and gray is perhaps also what the copper outlook can be described as with supply looking to flood markets. Forward looking indicators look very strong but in the short term we simply don’t believe that fundamentals can cope with supply floating Westwards from China (Read more here).

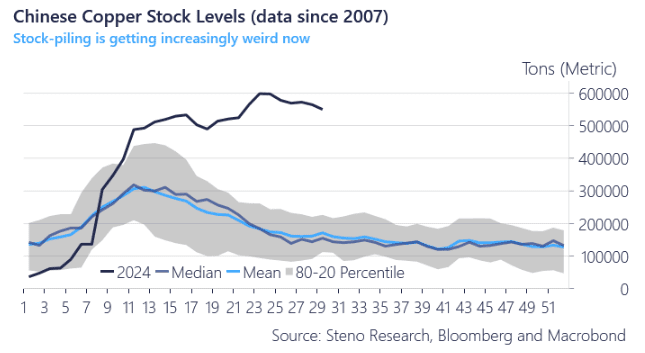

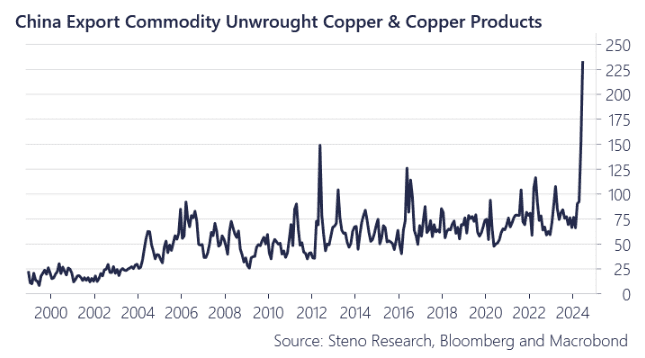

The chart below on Chinese copper exports for May and June is quite revealing. While the manufacturing cycle, including in China, shows signs of improvement, domestic copper consumption in China has likely plummeted (down 30% according to our metrics). The lack of concrete stimulus measures from the CCP Plenum, aside from some vague guidance on the use of funds from the recently issued ultra-long Treasury bond, is another letdown for the real estate sector. China remains inundated with refined copper, which suggests that this surplus will now head westward.

As a result, the improving cyclical dynamics in Western economies are likely to be overshadowed by an influx of import supplies in the coming months.

Chart 1.a: China built stock levels massively in the spring

Chart 1.b: Now they are flooding the market

Our short metals trade is starting to work very nicely, but we are also sensing the early stages of a turnaround in the consensus on metals. Meanwhile, the oil trade is currently quiet, while natural gas is bouncing for good reasons! It’s time for our Commodities editorial!

0 Comments