Energy Cable: Increases in freight rates not transferring into goods inflation (for now)

Greetings from Copenhagen!

We’ll take a look at freight rates, copper, and crude from an inflation angle. But before we do that, let’s have a quick look at Henry Hub.

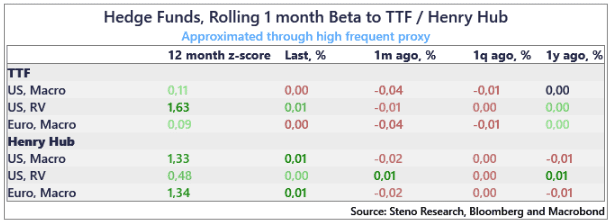

The front-month Henry Hub natural gas prices continue to face downward pressure, primarily influenced by an abundance in gas stock levels. Even though U.S. LNG exports have begun to increase, this uptick in exports has not been sufficient to significantly alter the overall market sentiment in the U.S., where weak import numbers from major countries like Japan and strong domestic stock levels dominate price action. The positioning data from hedge funds suggests further potential downside for Henry Hub, particularly if broader markets falter given the current betas of hedge funds to gas markets.

Chart 1: Troubles ahead for Henry Hub

Crude oil’s strong performance and rising freight rates signal potential inflation pressures, despite current weaknesses in goods inflation and metal prices. The market is though not overly scared of it (yet), but the curve steepening is a first hint of something brewing beneath the surface.

0 Comments