Energy Cable: China is killing the commodity super cycle

Take aways:

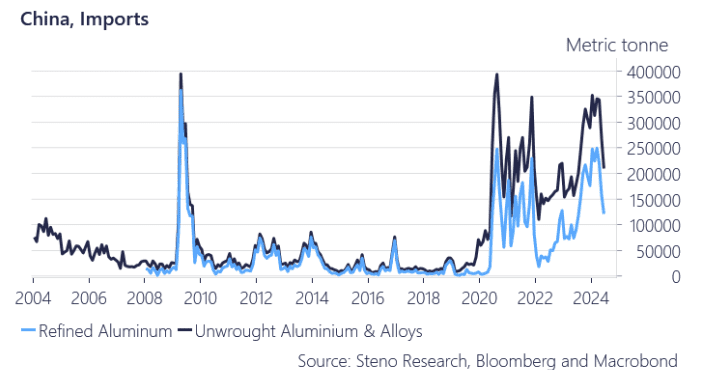

- Low margins and high stock levels mean that China will export its excess metal capacity

- Other commodities like crude and its derivatives look weak as well

- Gold only strong performing commodity in China due to domestic economic weakness

Welcome to this week’s energy cable with a focus on the economic troubles in China and its impact on commodity prices.

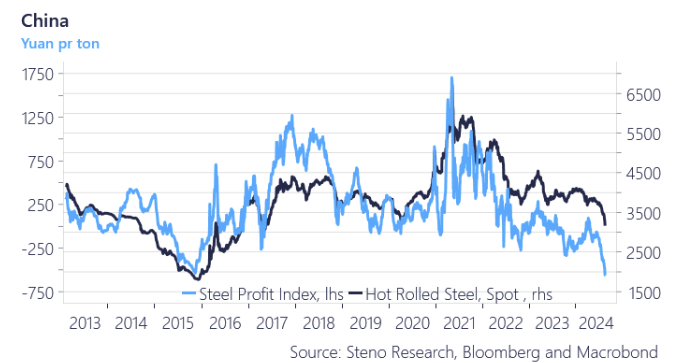

This week’s piece will have a lot of charts, therefore we’ll keep the text short. We start in steel markets. Steel manufacturers are experiencing negative margins for the first time since 2015, signaling significant shifts in commodity markets.

This follows a pattern initially observed in the copper sector this summer, where prices dropped sharply after haven risen over the course of the spring. Now, steel prices are also showing signs of fragility, suggesting a broader trend of commodity disinflation being exported from China.

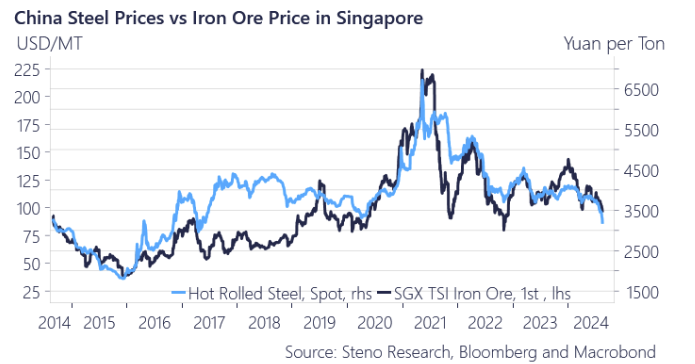

The likely consequence of negative steel margins in China is cost cutting (since there is no demand at higher prices) which will affect iron ore prices and countries exporting it.

Chart 1.a: No demand for higher prices, thus steel producers must cut costs

Chart 1.b: Short Australia?

Chart 1.c: Massive drop in aluminum imports from China

There is still a substantial weakness in the Chinese domestic cycle, which impacts the overall commodity cycle. Gold is one of the few commodities that hasn’t been a victim of the Chinese cycle, but is the sell-off broadly over in commodities? Doubtful.

0 Comments