Business Cycle Watch – What to buy if manufacturing keeps surprising to the upside?

Hello everyone, and welcome to a short and sweet look at the current business cycle, what to expect, and which assets to buy ahead of what could be significant cyclical expansion.

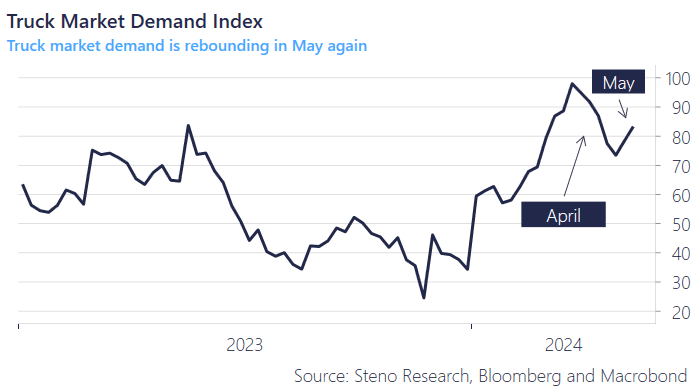

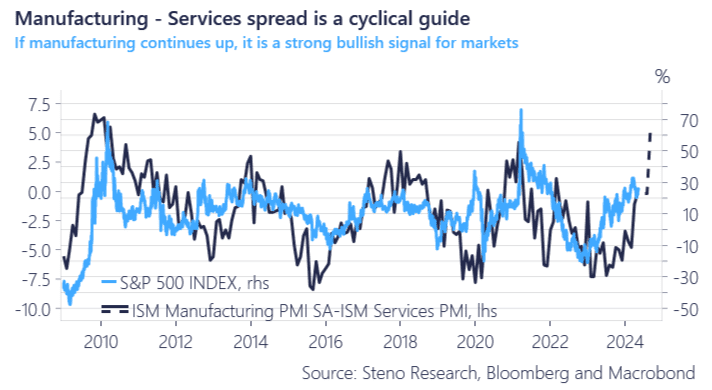

April data has in general been week in our models and nowcasts, which was reflected in the fairly dovish CPI report yesterday. However, May actitivity is picking up momentum again, and our Truck Demand indicator points to the business cycle picking up again from May onwards. The manufacturing to services ISM spread will therefore continue to rocket again, as the services sector is finally feeling the heat after years of acceleration, while manufacturing indicators are looking STRONG.

If we just plug in a forecast of a 5 point spread, we are looking ahead of a VERY strong equity season, but what equities are best to have in your portfolio if you believe the cyclical story? We’ll have a look.

Chart 1.a: April was weak, but May data will likely show the business cycle picking up

Chart 1.b: Manufacturing to services spread is increasing again

Although increasing signs of survey-based economic improvements being a head-fake, it’s still possible to capitalize on the upcoming increase in ISM manufacturing. Here’s the cheapest asset to buy relative to the business cycle in each asset class!

0 Comments