The Week At A Glance: Time to bet against the USD?

Greetings from Europe!

The Week At A Glance replaces our Morning Report each Monday as it allows for a deep dive into the economic releases and major tradeable themes for the week ahead.

We see a couple of major tradeable themes in the week(s) ahead.

First, the Euro area data, which is still improving in forward-looking indicators, while spot data remains relatively soft, probably in part due to a plethora of (potential) election risks. This week, we will get details from the IFO Institute alongside the early releases of Spanish and French inflation numbers.

Second, the relative inflation developments suggest that the current USDJPY trend may be running on fumes, with a soft PCE number paired with inflation data from Japan underpinning a fair value closer to 150 than 160.

Let’s have a look at the details.

European data – IFO details (Tuesday) and French/Spanish HICP numbers (Friday)

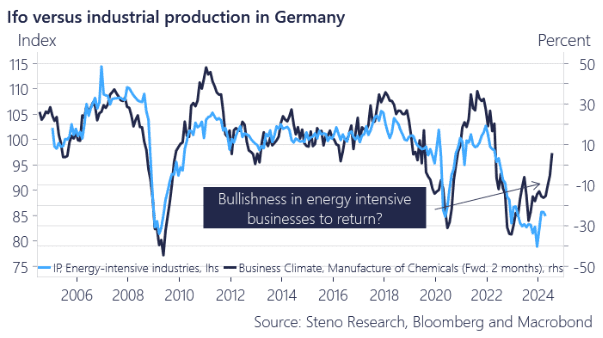

The IFO survey made for luke-warm reading early Monday morning, but the details released tomorrow provide the most signal value. Forward-looking indicators, such as the ZEW spread and orders/inventory ratios from the most cyclical sectors, suggest a rebound in German activity heading into the second half of the year.

Notably, the chemicals sector has shown a significant recovery in business conditions, supported by the softening of input prices, particularly energy costs.

Chart 1a: Germany is rebounding

Is it time to bet against the USD based on relative surprises and relative inflation numbers? The week ahead is full of interesting inflation data.

0 Comments