The Week at a Glance: Stagflation or (temporary) Goldilocks?

Remember that we are replacing our “Something for your Espresso” with “The Week at a Glance” every Monday, featuring forward-looking expectations for the macro trading week ahead.

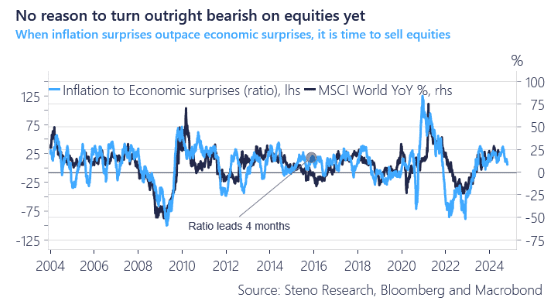

This week is another make-or-break week in US macro as growth surprises have turned negative lately. This is not a major issue as long as the inflation surprises follow, as fears of weaker growth are alleviated by softer discount rates and lower inflation expectations in such a case. A firm inflation report, in other words, would be the worst possible news for the current asset environment in the US.

Our proprietary growth-to-inflation surprise indicator is still in “bullish territory,” and we are accordingly not yet running for the hills. We believe that the current macro regime is friendly for risk assets but unfriendly for cycle-dependent commodities such as copper.

Let’s have a look at the key figure calendar for the upcoming week.

Chart 1: Inflation to growth surprises are not outright bearish yet

NFIB Small Business Survey: Still out of sync with the labor market?

Our favorite survey out of the US economy, the NFIB, is published already on Tuesday.

These were our main take-aways from the May report.

- Price Plans Drop: Expectations for future price hikes have decreased, offering some relief for the latter half of 2024.

- Compensation Plans Stabilized: Wage growth has stabilized after an early 2024 uptrend, indicating no current acceleration in wage increases.

- Actual Sales Bottomed: After a tough 2023 and early 2024, actual sales numbers are now on a positive trajectory despite a minor setback in April.

- Credit Availability Weak for SMEs: Credit availability remains volatile but is better than the weak levels of 2023.

- Hiring Intentions and Inventory Plans Increase: There is a slight increase in hiring and inventory plans, marking a potentially significant trend change.

In the upcoming June survey, we will be focusing on three key areas:

Inflation data from the US will take center stage this week after a week of weak growth gauges. Will the US momentum look stagflationary or smell of temporary Goldilocks?

0 Comments