The Week at a Glance – Is a 50bps Cut Good if Paired with Economic Weakness?

Good morning from Copenhagen.

It’s make-or-break this week with Powell taking the stage on Wednesday to reveal whether the rumors from Nick Timiraos about the Fed considering a 50bps cut were actually true after all.

Markets have been desperately hoping for the 50bps cut, as evidenced by the price action where Fixed Income is being bought regardless of the economic news. Not even a hotter-than-expected CPI report could get markets to turn on US bonds, which have become one of the most crowded trades, alongside gold. We are reaching the point in the cycle where everyone is locking in on the cutting cycle trades rather than assessing economic data as it comes in. Therefore, there is truly no value at the moment in betting against either US Fixed Income or Gold.

However, while markets are not putting too much emphasis on the economic data in September (which has actually been doing okay), we try to shed some light on the releases this week and whether the macroeconomic scene could pose any troubles for Powell when he takes the stage on Wednesday.

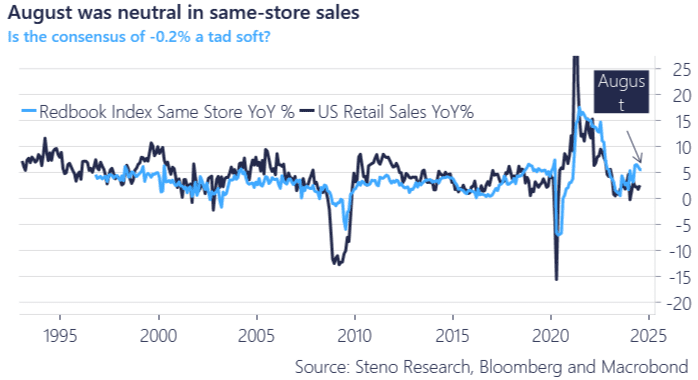

Event 1: Retail Sales (Tuesday)

We’ll get the monthly Retail Sales for August tomorrow, which is not insignificant given that we have been in an income-driven cycle after the pandemic, where excess savings and stimulus have kept consumption relatively high despite the Fed hiking interest rates.

From what we can observe in our nowcasts on consumption, things have actually stayed relatively stable during August, with congestion up and same-store sales flat. Hence, the consensus of -0.2% MoM (in seasonally adjusted terms) seems a bit overdone, but the question is whether the whole excess savings boost is starting to run on fumes.

It looks like markets are VERY honed in on a 50bps cut coming through on Wednesday, given their positioning in long US Fixed Income and short USD. So, a slightly hot retail print might actually not be that positive for risk assets as it would lower the chance of a 50bps cut somewhat. But are markets just locked in on a certain outcome with no leeway to change the narrative?

Chart 1.a: Consumer data was not a catastrophe in August

Markets are cheering for a 50bps Fed cut this week, but is it truly something to celebrate if it coincides with economic weakness? Lower rates are not always a positive for risk assets.

0 Comments