Energy Cable/Great Game: OPEC, things could get ugly!

Hi all,

Beginning this week, we’re merging our weekly coverage of the energy/commodity space and geopolitics. This will allow us to be even more actionable and specific when analyzing global events, as the ramifications of war and peace are most often felt in the commodity space.

Take aways:

- Increasing crude production in the current environment likely means a >25% drop in crude oil prices.

- There’s significant open interest in December crude put options.

- Geopolitically, major players are closely monitoring OPEC’s decisions.

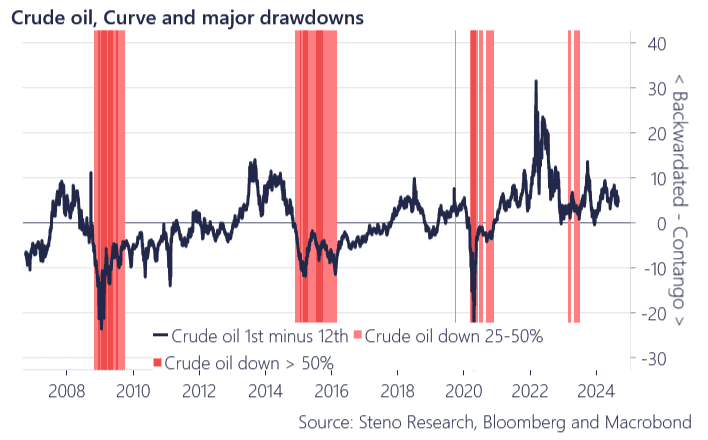

In energy markets, all eyes are on OPEC as their decision on production hikes is imminent. This decision will be crucial, both in terms of potential economic costs and for the cartel itself. We don’t expect OPEC to hike production given the bleak economic outlook and the fact that historically, flipping the futures curve from backwardation to contango has coincided with 3 of the last 4 large drawdowns in crude oil.

Chart 1: When the curve flips it is time to get out!

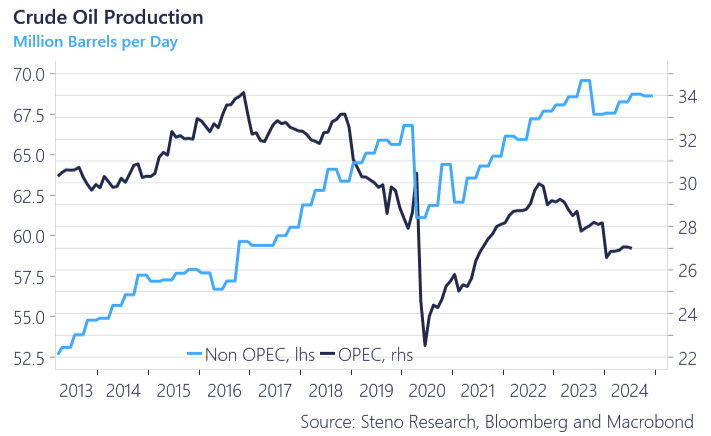

Speculation is mounting on whether OPEC+ will follow through on its June plans to ramp up oil production in Q4 and into 2025. OPEC+ typically announces policy shifts one month ahead, suggesting a decision could be imminent. The eight countries tasked with rolling back the 2.2 million barrels per day (mb/d) of cuts starting October 1st are favoring a strategy that prioritizes volume over price.

The UAE, with its substantial spare capacity, likely supports this approach. Additionally, the recent drop in Libyan oil production by up to 1 mb/d could further bolster the case for increasing output.

However, this strategy carries risks if OPEC+ prefers to keep oil prices high. The global demand forecast, especially in China, has softened since June, as we also covered in our Steno Signals editorial on Sunday. Despite Q3 traditionally being a peak demand period due to summer travel, a reduction in demand is anticipated for Q4.

This plan to increase production contrasts with divergent views on demand projections. OPEC predicts a rise in global oil demand by 2.1 mb/d this year and 1.8 mb/d next year, while the International Energy Agency (IEA) anticipates increases of only 1.0 mb/d and 1.1 mb/d, respectively. Although the IEA’s estimates might seem cautious, OPEC’s figures appear overly optimistic, especially since Goldman Sachs recently downgraded its oil demand forecast for 2025.

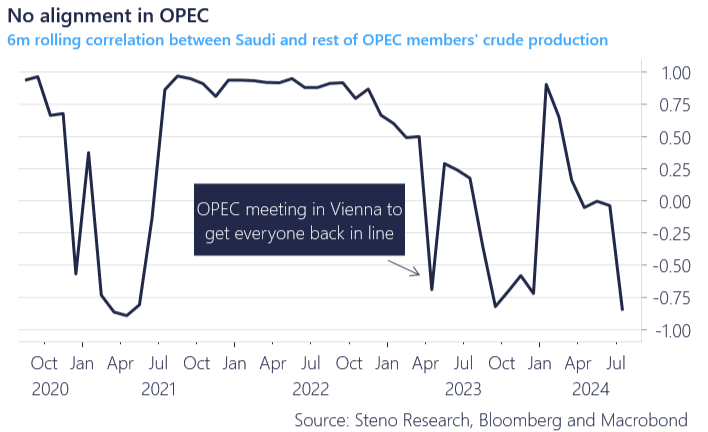

If OPEC remains silent over the upcoming weekend, and this silence extends beyond the OPEC+ Oil Market Report on September 10th, or if OPEC+ confirms the planned production increases, Brent crude prices could drop markedly.

Chart 2.a: The structural shift in crude oil production

Chart 2.b: Alignment in OPEC is still off. How much longer can MBS live with this?

Beginning this week, we’re merging our weekly coverage of the energy/commodity space and geopolitics. This will allow us to be even more actionable and specific when analyzing global events, as the ramifications of war and peace are most often felt in the commodity space.

0 Comments