EM Watch: Time to play the long end of the Chinese yield curve?

Welcome to our weekly EM Watch, where we examine Emerging Markets (with a particular focus on China) from the perspective of Western investors.

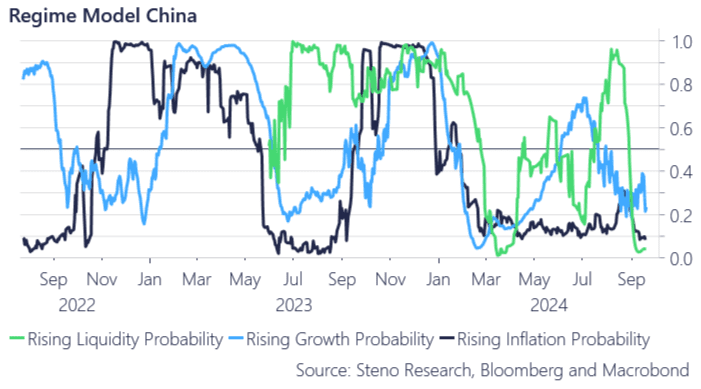

It continues to be a rough month for anything linked to China. We have observed early signs of stabilization in China’s pollution data, which may indicate some level of stability at lower levels of industrial output. However, we have also seen a further decrease in the likelihood of rising inflation and increasing liquidity in China, following the early influx of PBoC liquidity this summer.

The prevailing trend in China remains negative—declining growth, inflation, and liquidity—which sharply contrasts with the growing consensus that the EM cycle is decoupling from the DM cycle. China is certainly not an example of this trend.

Using M1 as an indicator for Chinese PPI, it appears that disinflationary pressures in China are far from over. This is good news for central bankers eager to accelerate their rate-cutting cycles, but bad news for global businesses reliant on a strong China. Aside from money supply, operating profits, the number of loss-making companies, and measures of labor costs all look dreadful.

You will likely not see any official numbers out of China reflecting a complete downturn, but with the help of our nowcasting tool, which uses alternative data that is more difficult to manipulate, we find support for the continuation of the China disinflation thesis.

Chart 1.a: Our three variables for our regimes are below 50% probability of increasing

Is there no end to the bid in Chinese longer-dated fixed income? Our growth, inflation, and liquidity models for China still suggest that Chinese fixed income remains the only worthwhile investment among liquid asset classes in the country.

0 Comments