EM Watch: The Chinese race towards 0% interest rates

Welcome to our Weekly EM Watch, where we look at China and other large EM countries through the lens of Western macro investors.

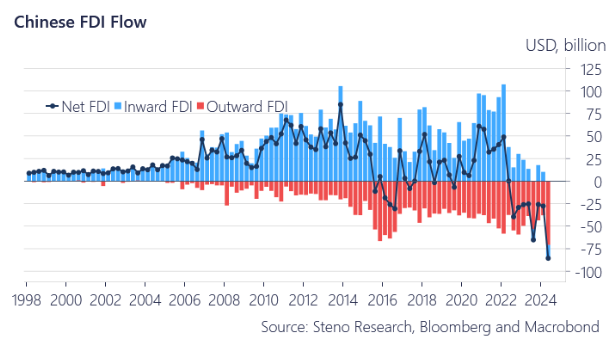

Over the past week, we received the latest quarterly update on Chinese foreign direct investments and the situation went from dire to abysmal. There is a net negative inward FDI flow, and despite a significant $190 billion surplus in customs goods and services, the basic balance, which comprises both the current account and FDI, recorded a substantial deficit of $30 billion for the first time.

This scenario should be highly unusual, raising concerns that the current account might be underreported. The discrepancy seems to have grown since 2022, when SAFE discontinued using customs data for balance of payments calculations.

In essence, the true scale of capital outflows is likely more severe than what is currently reflected in the available data. My friend Brad Setser has done extensive work on this, which you may find interesting.

Chart 1: Chinese official FDI flow data looks bad

Chinese monetary authorities are fighting against gravitational forces when pushing for higher bond yields. Meanwhile, investors keep piling into bonds, while they are selling stocks. Credit growth is too weak to do otherwise!

0 Comments