In a little while, we will release our Eurozone CPI preview, but until then, the floor is mine!

Like many others, I spent last night watching Waller’s speech. Searching for relevant points in subtle Fed member speeches is rarely productive, but the ambiguity in Waller’s speech served to confirm one thing:

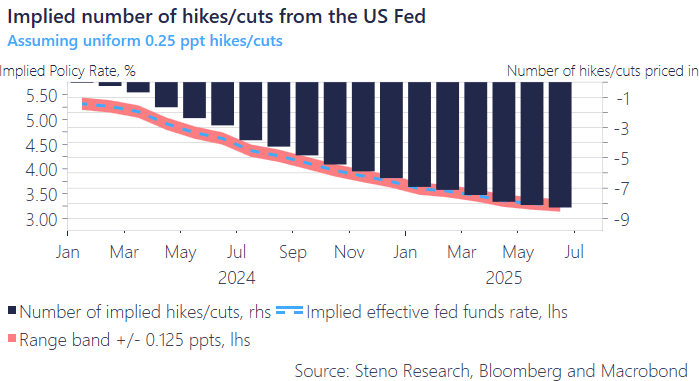

If we are indeed in a soft landing territory for 2024, the number of cuts to be made by Powell & Co. is substantially lower than what the market currently anticipates.

While not committing to any specific path ahead, the emphasis on maintaining real rates at their current level, provided that the underlying economy remains stable, was a clear hint to me that the Fed will adjust rates proportionally with progress on the inflation front.

If true there is no shortage of feet to be wrongfooted if the US economy holds up

Chart 1: Fed, Implied policy

0 Comments