Something for your Espresso: Time to spend again

Morning from Europe!

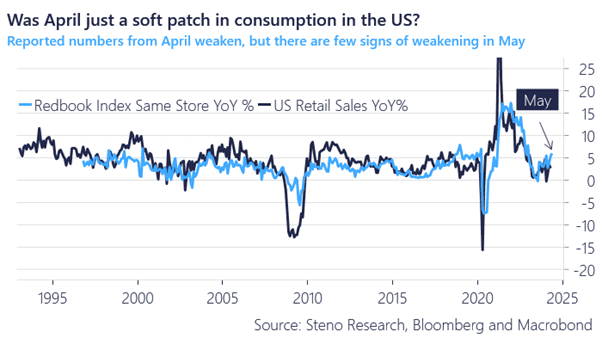

Those who are looking for an imminent recession continue to look like those constantly searching for an excuse to call the end of the Petrodollar. We just received a major upwards revision to the German retail sales in April and we are likely to see decent trends out of the US as well now that wages are outpacing inflation again.

US consumption is most likely picking up speed, as suggested by rising withheld taxes and real-time indicators like same-store sales. But the market seems more obsessed with disinflation, so a robust retail sales report from May probably won’t shake up the rates markets. After all, everyone already thinks the FOMC June projections are overly hawkish.

Still, a strong report might give Consumer Discretionary stocks a summer boost, and the USD could keep outpacing the EUR, which is still limping along with the”French disease.”

We see a strong risk/reward case on the high side of consensus for US retail sales and our numbers are in line with some of the most precise retail sales forecasters empirically.

Chart 1: A positive surprise from the US today?

The US retail sales will likely make for upbeat spending reading right as the spending cycle is starting to improve outside of the US as well with upwards revisions in Germany.

0 Comments