Something for your Espresso: Time to fade?

Good morning from Europe

The November bear market rally totally blindsided the shorts who’ve been partying since summer. December usually isn’t a terrible month for risks, but we don’t want to jump into the short-selling game too soon. Still, it’s hard to ignore the USD’s downward spiral, which seems to be fueling cyclical and equities alike.

The subdued CPI reading indeed sparked risk sentiment, but it might be wise to consider if the recent sharp movements are poised for a reversal at this juncture.

The CPI slightly outperformed expectations (as we accurately predicted), yet the resulting market reactions have been far from modest. While the market leans towards another December pause, there’s a possibility that upcoming releases could stir things up.

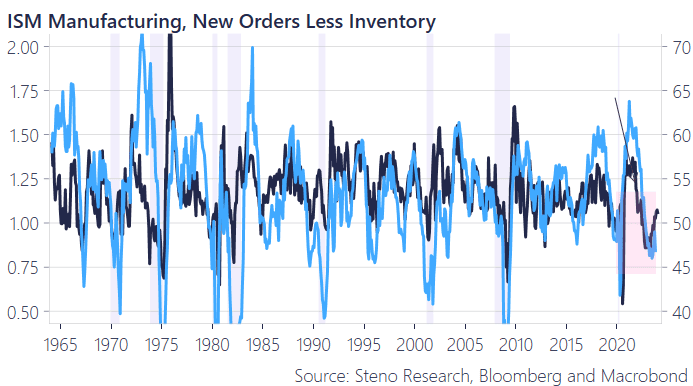

Some signs of US resilience are still apparent for now: New Orders Less Inventory still hinting at higher print:

Chart 1: ISM Manufacturing Order less inventory

Time to fade the risk rally or is december the last domino? Read our morning thoughts below

0 Comments