Something for your Espresso: Tightening the noose on Consumers

Good morning everyone!

We are back at the desks this morning. Everything this week is about the US inflation report and after our preview here from Yesterday I thought it appropriate to start the morning with some additional complimentary points.

First of all, it is worth noting how expectations are generally trending down: According to the inflation expectations survey conducted by the New York Federal Reserve, consumers anticipated a 3.8% inflation rate over the next 12 months in June. This figure is a decrease from the 4.1% reported in May and a significant drop from the 6.8% recorded one year ago. Furthermore, the survey indicated that three-year ahead inflation expectations hovered slightly below 3% in June, showing a decline from the 3.6% reported a year ago- in other words NY FED inflation expectations are at the lowest in 2 years.

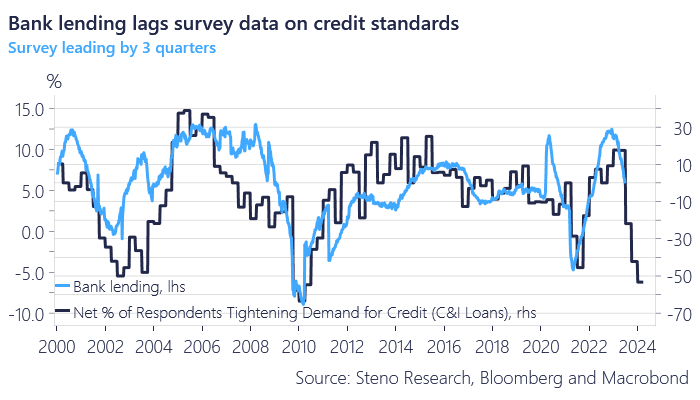

Secondly, we may well be in an exceptional environment full of false flags but with consumers expecting inflation to ease and banks reporting tighter lending standards it is not at all surprising that Consumer credit is facing headwinds:

Chart 1: Bank Lending vs Tightenings standards survey

All eyes are on the CPI release this week. We believe risks are skewed toward a below-expectations print and we now see the monetary policy increasingly passing through to key areas for consumers. Could July be the last hike?

0 Comments