Something for your Espresso: The tide is turning on a few important macro trends

Morning from Europe!

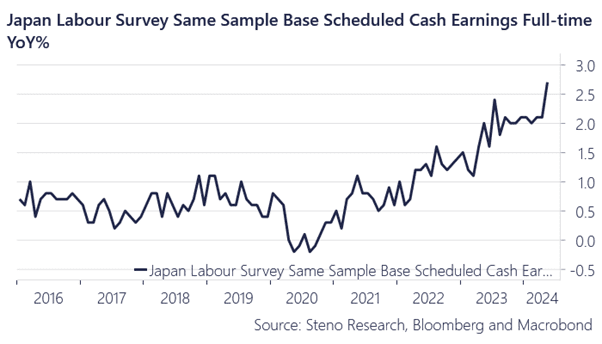

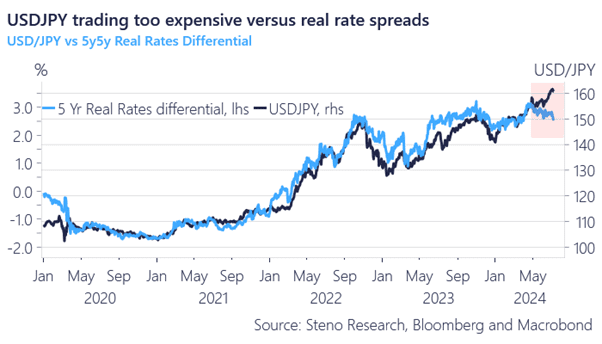

The momentum in USDJPY’s upward trend appears to have plateaued, particularly in light of yesterday’s robust monthly cash wages/earnings data from Japan, indicating a potential shift in macroeconomic fundamentals for USDJPY. Analyzing the attached chart, which compares USDJPY against real rates, reveals an attractive opportunity to increase JPY exposure at this juncture.

Additionally, it is noteworthy to observe the “toppish” price action in Gold, Silver, and, to some extent, Copper, alongside the waning momentum in USDJPY and USDCNH. These trends seemed tightly correlated with increased metal purchases by both official and unofficial Asian accounts as a hedge against currency debasement risks. The absence of PBoC purchases in June supports the view that the USD may be weakening against Asian currencies, creating a compelling scenario where the USD could decline in tandem with falling metal prices.

Chart 1a: Japanese wages on the rise

Chart 1b: USDJPY versus real rates

Fair values are no longer moving up for USDJPY, which in turn may lead to spill-overs to commodity space. Is the tide turning on a few important macro trends? And will Powell confirm the turning tide?

0 Comments