Something for your Espresso: The one on Powell, freight, oil and Copper

The takeaway from Powell’s speech in Sintra yesterday is somewhat soft, but I still don’t get the impression that a rate cut is imminent.

The JOLTS job data supports the idea that the public sector will continue to sustain the economy until November with ample money and job opportunities, reducing the necessity for a short-term insurance cut.

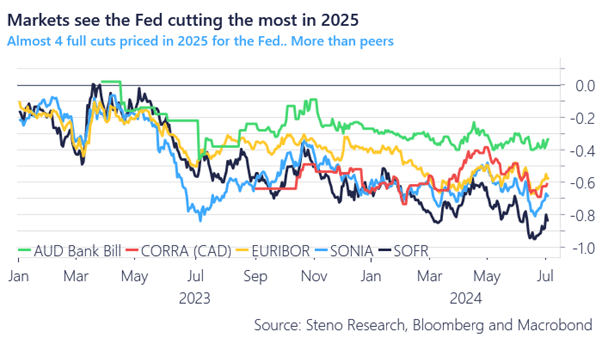

Markets still predict that the Fed will be the most dovish central bank among the major ones in 2025 (see the attached chart), and this trend is widening.

Additionally, the “reflation bear steepener” seems to be tactical in nature. With potentially strong numbers from the ISM Services survey and the NFP on Friday, I’m inclined to believe that further easing could be postponed to 2025 instead of 2024.

How should we approach this? I believe there is some merit to broad flatteners, such as the 1-year versus 10-year, but we are currently having internal discussions on how best to express this view.

Chart 1: The Fed is priced as the most dovish CB in 2025 (spread Dec-24 and Dec-25)

Powell sounded dovish in Sintra, but there are no imminent rate cuts on the horizon. Meanwhile, the oil market continues to send mixed signals, and freight rates are skyrocketing. Are you paying attention?

0 Comments