Something for your Espresso: The cutting bias is intact

Morning from Europe

Despite the soft inflation data yesterday, the FOMC significantly changed the dot plot. They likely believe the CPI report was noisy due to a sudden deflation in transportation services and the labor market remains their best excuse to cut rates early, as any unexpected weakening can be framed as “worse than forecast,” even though their forecast is already flat.

The market is already “ahead” of the new dot plot, but for the first time in a while there is a decent probability that inflation will print around the forecasted path or maybe even lower, especially if we see continued disinflation in both insurance costs and housing.

The bottom-line is that we need to remain UPBEAT on risk assets as the Fed keeps an easing bias intact despite a hawkish revision of the FOMC projections. That cocktail is reflationary in nature.

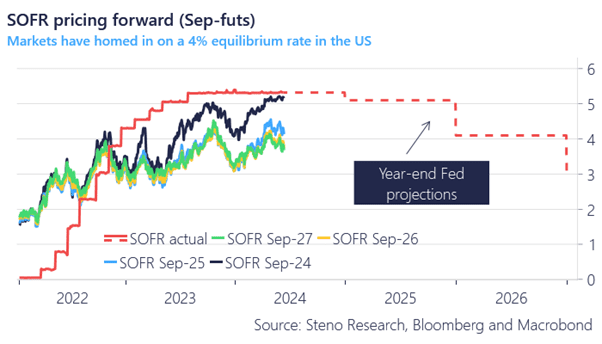

Chart 1: Forward pricing versus the dot plot

Despite a hawkish revision of the FOMC projections, the market can take comfort in a solidified cutting bias despite these changes. There is now even a feasible path to dovish surprises relative to the inflation base case.

0 Comments