Something for your Espresso: The Asian Waiting Game

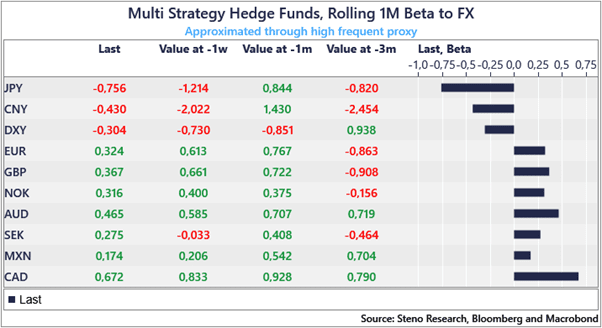

Morning from Europe, where we are awaiting news from Asian monetary authorities. It appears hedge funds have scaled down their USD vs. Asian FX longs over the past 2-3 days as we approach intervention territory in both USDJPY and USDCNY again.

Our high-frequency positioning scoreboard, based on daily data from Multi-Strat funds, suggests that positioning has been cut in half or thereabouts against the JPY and CNY since a week ago.

The big question is whether the “line in the sand” remains roughly at the same levels as seen earlier at 7.30 in USDCNY and 160 in USDJPY, respectively. So far, there are no signs of massive official intervention, though proxies hint at material intervention in Yuan markets from “private” state banks.

Chart 1: Positioning in FX from multi strat hedge funds

Markets await further action from the Asian monetary authorities with both JPY and CNY in the intervention zone again. In contrast to earlier rounds of intervention, we are much less certain that precious metals will thrive.

0 Comments