Something for your Espresso: Signs of inflationary life from the monetary canaries

In May, the Australia CPI surprised to the upside, as did the Canadian and Swedish CPIs, signaling signs of re-inflationary life outside of the US. It is particularly interesting that inflation in AUD, SEK, and CAD is starting to surprise to the upside.

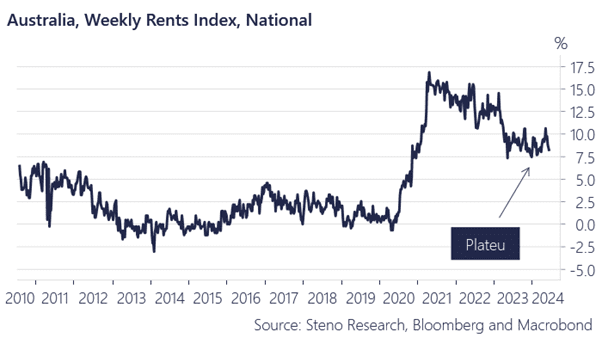

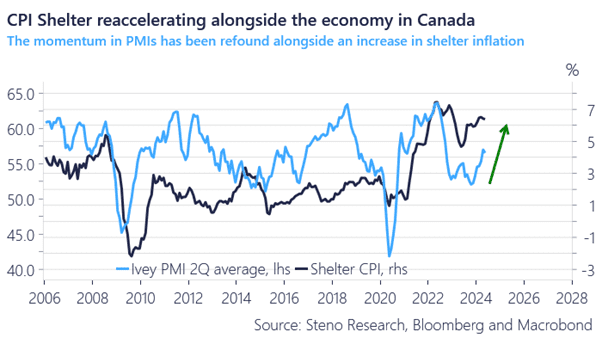

These countries, with their low-duration profiles, might be the true monetary canaries here. Contrary to expectations, the housing market is heating up in Canada, and rents have at best found a plateau at high levels in both Australia and Canada.

This trend aligns with the reacceleration observed in the IVEY PMI since the rate of change in interest rates began to soften, and also to a certain extent, aligns with the reacceleration seen in Australian job creation.

We wrote a story on how it impacts the inflation cycle views elsewhere around the globe and whether it is even feasible to expect inflation to return to target anywhere in G10 here.

Chart 1a: Rents national YoY in Australia

Chart 1b: The Canadian economy is re-accelerating

Hawkish surprises from Sweden, Canada and Australia. Is this something to worry about for the bond bulls in G3 markets as well? We tend to think so. Meanwhile, liquidity proxies rebound despite quarter-turn drains.

0 Comments