Something for your Espresso: Punching in thin air!

Morning from Europe!

Both the SNB and Norges Bank will report within 60-90 mins of the release of this report, while the BoE is probably the most important central banking meeting from a global perspective.

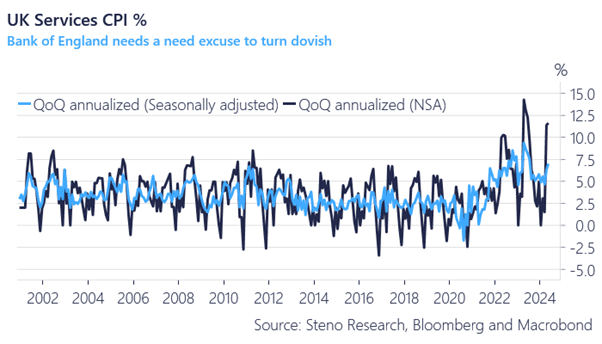

The UK CPI report came in smoking hot in services again and the BoE needs to hang on to the goods deflation if they want an excuse to turn dovish ahead of the election. The BoE started explicitly referring to a softening of the 3m/3m services inflation in May with the trend looking benign at the time (4.66% QoQ annualized in SA terms). We have since had two smoking hot reports taking the QoQ annualized in SA terms to 6.99%. This has to be considered a strong hint that the BoE will have to firm up the rhetoric today.

The re-acceleration in services is an issue for the BoE, especially once/if the deflationary trends in goods are over. We are already seeing the first spill-overs from the red sea malaise in the transport sector costs and the UK is probably the market that will face the largest repercussions should we see a broad pass-through of freight to goods pricing.

Chart 1a: The BoE’s new favorite measure (3m/3m SA services) has re-accelerated sharply

Markets have been choppy with the Americans away from their desks due to Juneteenth. Are commodity bulls punching in thin air ahead of July? Meanwhile, we have a big day ahead in central banking.

0 Comments