Something for your Espresso: Markets Use All Tiny Arguments to Sell the USD

Good morning from Copenhagen,

It was a rough day for both the USD and USD rates yesterday, as relative yield differences between the US and its peers have come into the spotlight. The US is now the lower-yielding country compared to its peers, which is likely reflected in yesterday’s price action.

There wasn’t much on the calendar that could have moved the USD, especially USD rates. The only dovish surprise was the lower revision in the PPI figure. However, the ECB meeting confirmed that both the BoE and ECB are now more hawkish than the Fed (who would have thought?), at least on a relative basis.

We have admittedly been wrongfooted in our positioning this week. The “dash for cash” dynamics in the USD have been outweighed by the dovish rates outlook, and the USD is selling off against almost everything. Positioning also looks dire in our high-frequency hedge fund positioning proxy, and things are starting to look uniform – everyone is betting on lower rates and a weaker dollar.

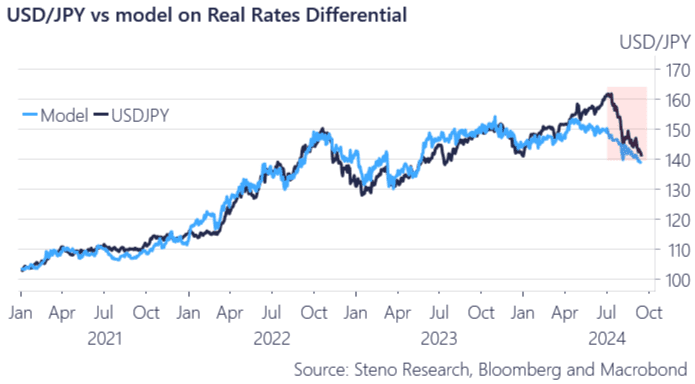

The key point to remember here is that the USD is approaching fair value across currencies based on real-rate differentials. It’s unlikely that we’ll see a complete nosedive in USD crosses, but the trend is downward, including in rate differentials, making it tricky to bet on a stronger USD here.

Chart 1.a: The USD is approaching fair values, but the trend in rate spreads is down

The USD and USD rates continue their trend lower, as it seems markets are using any argument to bet on lower rates following the small revision of the PPI and the slightly hawkish ECB meeting yesterday.

0 Comments