Something for your Espresso: Lindner vs Meloni

Good morning!

Yet another morning and yet another morning post at your service!

We seem to have nailed the material downside to Eurozone PMI yesterday and we feel the path for further surprises is pretty much skewed to the downside at this point. As mentioned in yesterday’s morning post the picture is a bit muddier when we look at soft data- especially the MoM Survey indices.

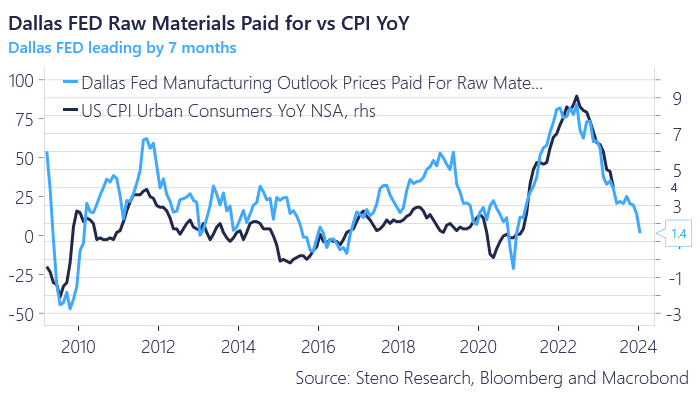

But when it comes to inflation I would argue the path is somewhat smoother- we see inflation volatility come crashing down on both sides of the pond (see for instance here the probabilistic of inflation uncertainty in this latest ECB release) and the very same indicators that warned us about the inflationary shocks which policymakers shamelessly overlooked in 2021 point to a slide

Chart 1: Dallas FED vs CPY YoY

CB’s remain behind the curve and the politicians have tough calls to make in coming months. Markets remain calm but for how long?

0 Comments