Something for Your Espresso – Has the USD Real Rate Trend Come to a Halt?

Morning from Copenhagen.

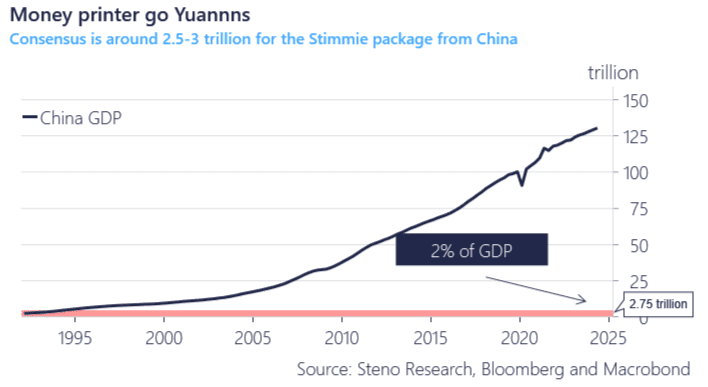

We are seeing Hang Seng on the move again today after yesterday’s news that China is preparing stimulus in size to be announced on October 12th. Based on what we are hearing from clients and counterparts, the consensus on the street is a package of 2.5-3 trillion CNY (around 400 billion USD), which is FAR more than the vouchers and other liquidity injections proposed just a couple of weeks ago. We’ll see in which format the stimulus comes, but we are talking roughly 2% of GDP worth of stimulus, and 3-4% of the total equity market in China plus Hong Kong.

Everyone is still piling into what is perhaps the most hated rally ever, and it might not stop here if the street consensus is right. The question is now whether the authorities can top the expectations to get the desired move in asset prices, now that consensus is starting to feed into equities, rates, etc.

Chart 1: Rather large stimulus package if street consensus speaks the truth

China is preparing stimulus in SIZE, but with USD real rate trends stalling and U.S. CPI data looming, the focus shifts to whether authorities can exceed expectations to further drive asset prices.

0 Comments