Something for your Espresso: Goods Servicing Bailey

Morning from Europe!

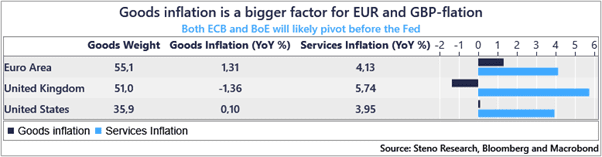

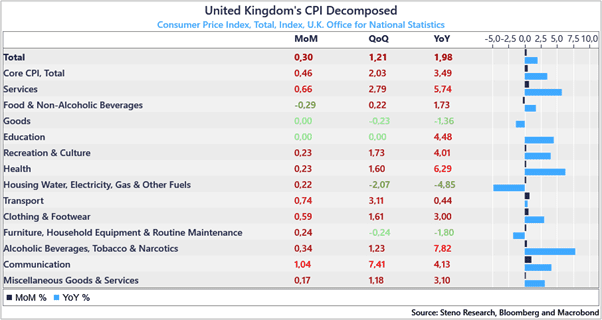

Yet another scorching hot Services CPI report from the UK, outstripping even ourout-of-consensus call by a few bps. While other components were softer, Bailey and his ilk got a free pass from goods again. But they better not get too comfortable because relying on goods to bring inflation down with base effects poised to push goods inflation up and transportation costs climbing thanks to the latest Red Sea debacle.

Services are surging at almost 0.7% MoM, transportation’s up 0.74% MoM (no doubt linked to Red Sea woes), and only the softness in goods and food is keeping the headline figure from going up again. If goods start to re-inflate, the BoE will find itself deep in the doodoo.

It still seems like wishful thinking for the BoE to tame inflation this year as goods base effects will make UK YoY inflation rise markedly from here, while services show few, if any, signs of decelerating.

Chart 1a: Goods versus Services in G3

Chart 1b: Details from the May CPI report in the UK

Chart 1b: Details from the May CPI report in the UK

Another smoking hot UK services report has emerged, presenting a renewed headache for the BoE. Without the deflation in goods, the BoE would be in a significant mess. Meanwhile, metals markets are heating up again.

0 Comments